E-mini Dow Futures - Taking a Breather

rhboskres

Publish date: Wed, 06 Mar 2019, 04:32 PM

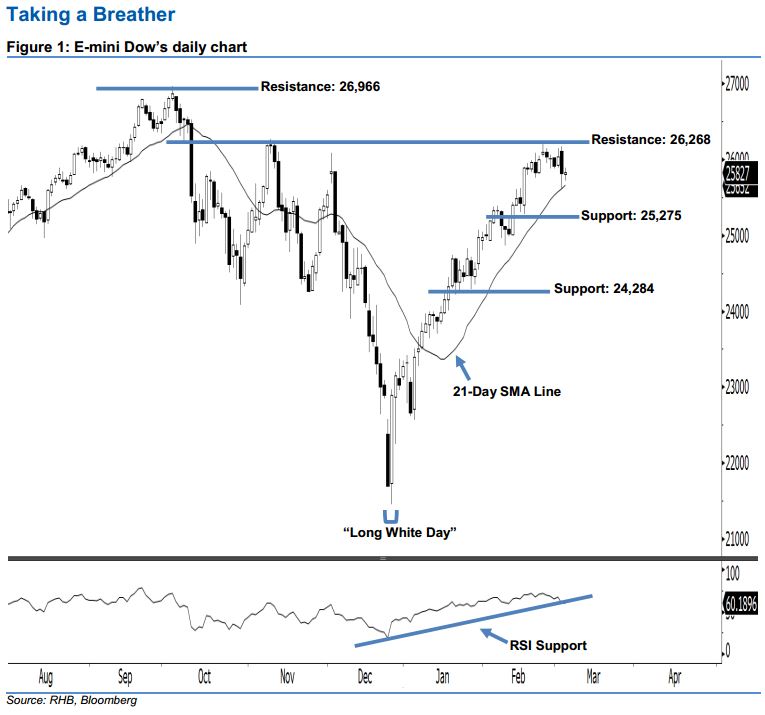

Maintain long positions. The E-mini Dow ended higher to form a “Doji” candle last night. It gained 13 pts to close at 25,827 pts, after hovering between a high of 25,890 pts and low of 25,721 pts throughout the day. However, the appearance of yesterday’s “Doji” candle can only be viewed as buyers probably taking a breather after the recent surge. On a technical basis, the bullish sentiment stays intact. This is as long as the index does not close below the 25,275-pt support mentioned previously. Overall, we think that the market rebound – which began with 26 Dec 2018’s “Long White Day” candle – may persist.

According to the daily chart, the immediate support level is seen at 25,275 pts, which was the low of 15 Feb’s long white candle. If a breakdown arises, look to 24,284 pts – obtained near the lows of 23 and 28 Jan – as the next support. On the other hand, we anticipate the immediate resistance level at 26,268 pts, defined from the high of 8 Nov 2018. Meanwhile, the next resistance would likely be at the 26,966-pt historical high.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 22,400-pt level on 27 Dec 2018. At the same time, a trailing-stop can be set below the 25,275-pt mark in order to lock in part of the gains.

Source: RHB Securities Research - 6 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024