COMEX Gold - Retracement Continues to Develop

rhboskres

Publish date: Wed, 06 Mar 2019, 04:44 PM

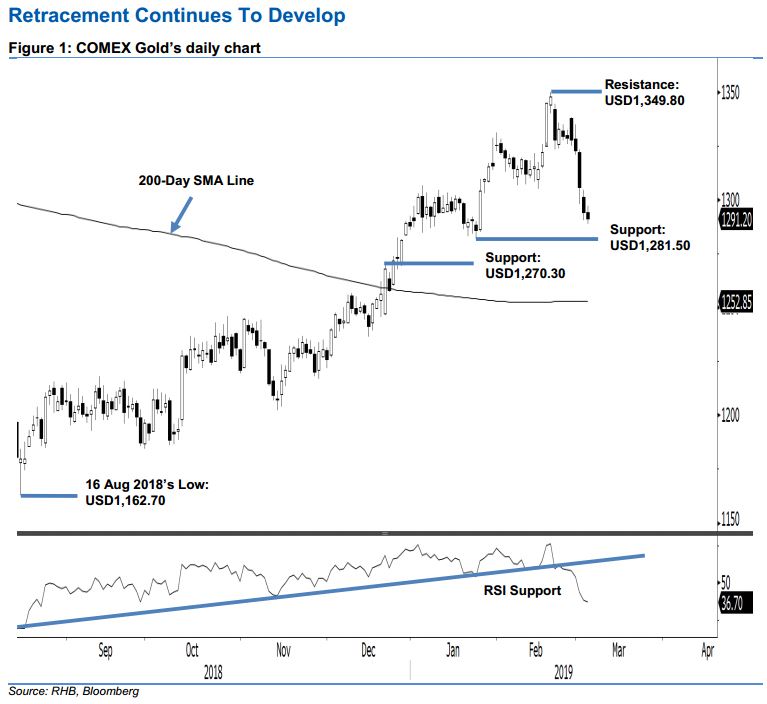

Maintain short positions to ride on a multi-week correction. The COMEX Gold extended its decline in the latest session, although in a less intensive fashion vis-à-vis the prior sessions’ sharp decline. Trading ranged between USD1,288.50 and USD1,297 before ending at USD1,292.20 – this indicated a decline of USD2.80. Broadly, we continue to be biased on the commodity being in the process of developing – at a minimum – a multiweek correction phase. However, we also note that it is too early to determine the possible correction pattern at this juncture, as it is still in the early phases of development. The Daily RSI – which has not flashed out oversold readings – is indicating room for further weakness. We maintain the short bias.

With the bias that the correction is still in the early stages of development, we continue to recommend traders stay in short positions. These positions were initiated at USD1,322.70, which was the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed above the USD1,349.80 level.

Immediate support is set at USD1,281.50, which was the low of 24 Jan 2018. The second support is at USD1,270.30, or the high of 20 Dec 2018. On the other hand, the immediate resistance is set at USD1,349.80, ie the high of 20 Feb. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 6 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024