E-mini Dow Futures - Long Positions Still in Play

rhboskres

Publish date: Thu, 07 Mar 2019, 05:21 PM

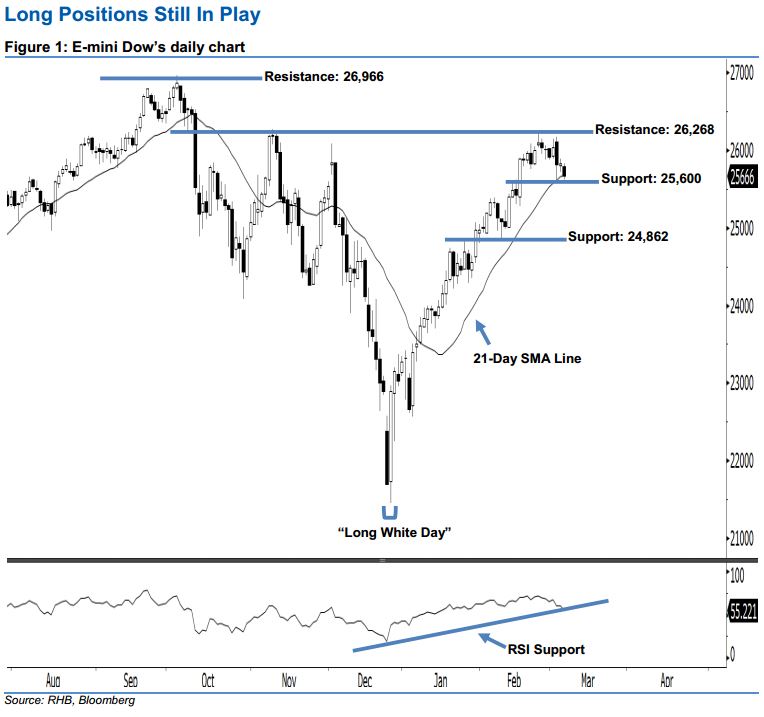

Stay long, with a new trailing-stop set below the 25,600-pt level. The E-mini Dow formed a black candle last night, declining 161 pts to close at 25,666 pts – this was off the session’s high of 25,832 pts. However, we believe the upside momentum is not over yet, as the index continues to hover above the rising 21-day SMA line. Yesterday’s black candle was the result of profit-taking activities after the recent gains, in our view. Presently, from a technical viewpoint, the bullish sentiment remains unchanged as long as the E-mini Dow does not erase more than 50% of the gains from 15 Feb’s long white candle. Overall, the market trend remains bullish.

As seen in the chart, we are now eyeing the immediate support at 25,600 pts – this is situated near the midpoint of 15 Feb’s long white candle. The next support is seen at 24,862 pts, which was determined from the previous low of 8 Feb. Towards the upside, we maintain the immediate resistance at 26,268 pts, ie the high of 8 Nov 2018. If a decisive breakout occurs, the next resistance is anticipated at the 26,966-pt record high.

Recall that, on 27 Dec 2018, we initially recommended traders to initiate long positions above the 22,400-pt level. We continue to advise them to stay long for now while setting a new trailing-stop below the 25,600-pt threshold. This is to lock in a larger part of the profits.

Source: RHB Securities Research - 7 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024