COMEX Gold - Bears Are in Control

rhboskres

Publish date: Tue, 12 Mar 2019, 09:39 AM

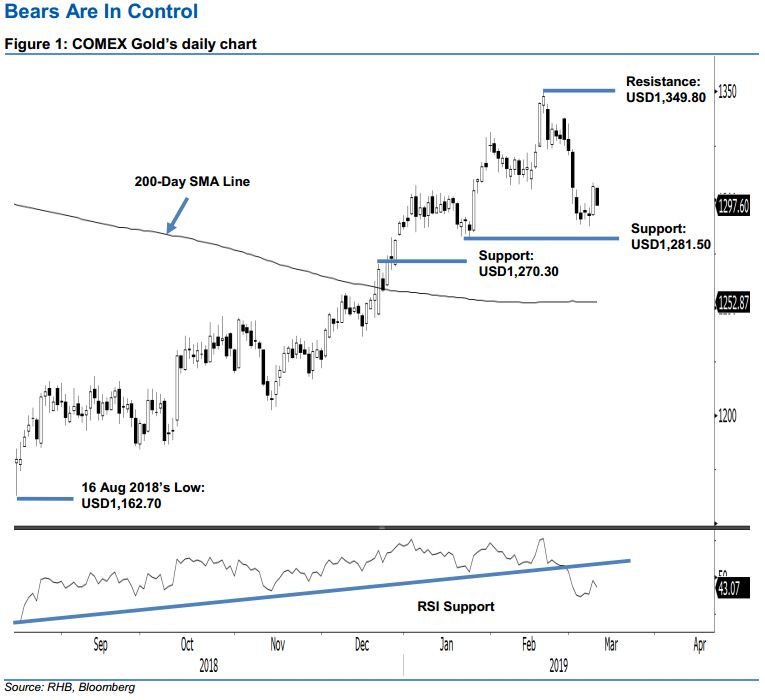

Maintain short positions as the correction phase is still developing. The COMEX Gold closed the latest session weaker by USD8.40 at USD1,297.60. The low and high were registered at USD1,297.10 and USD1,305.60. The weak session meant there was no positive follow-through from the prior session’s positive performance – this implies that at this juncture, the probability for the commodity to stage a deeper rebound or total price reversal is relatively low. Broadly, we are still looking for the precious metal to extend its ongoing correction phase, which started from USD1,349.80 on 20 Feb, to correct its previous multi-month’s upward move. Maintain our negative trading bias.

As there are no signs to suggest the correction phase has reached an end, we continue to recommend traders stay in short positions. These positions were initiated at USD1,322.70, which was the closing level of 1 Mar. For risk-management purposes, a stop-loss can be placed above the USD1,349.80 level.

The immediate support is expected at USD1,281.50, which was the low of 24 Jan 2018. This is to be followed by USD1,270.30, or the high of 20 Dec 2018. Conversely, the immediate resistance is set at USD1,349.80, ie the high of 20 Feb. Breaking this may see market test USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 12 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024