E-mini Dow Futures - Still Expected to Decline

rhboskres

Publish date: Wed, 13 Mar 2019, 05:36 PM

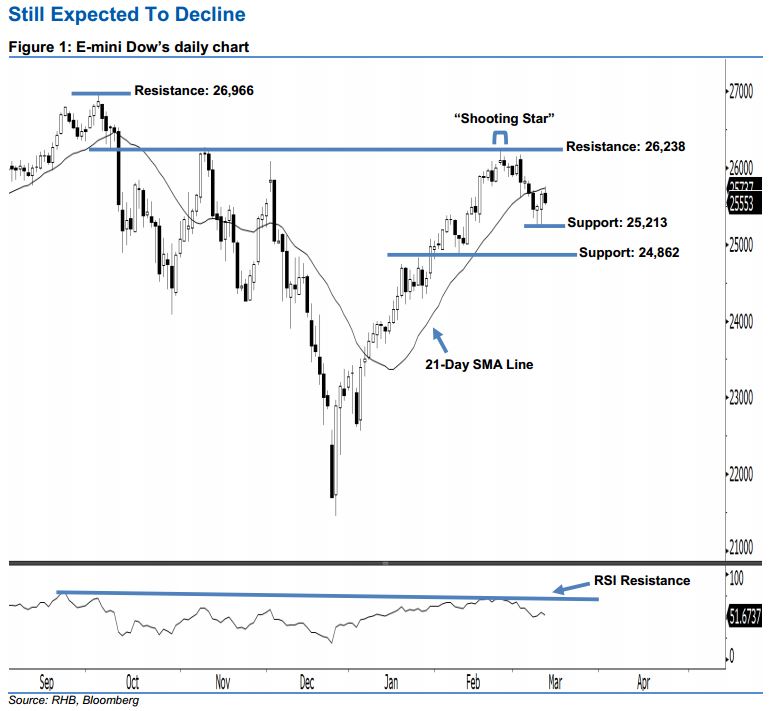

Stay short. The E-mini Dow formed a black candle yesterday. It lost 100 pts to close at 25,553 pts, off its high of 25,759 pts and low of 25,512 pts. Based on the current technical landscape, the market sentiment remains bearish, as the index has continued to stay below the previously-indicated 26,238-pt resistance for more than two weeks. On a technical basis, as the “Shooting Star” pattern that formed on 25 Feb has not been negated, this shows the downside swing stays intact. Overall, the market trend remains negative.

According to the daily chart, the immediate resistance is now seen at 26,238 pts, ie the high of 25 Feb’s “Shooting Star” pattern. If a breakout arises, the next resistance is anticipated at the 26,966-pt historical high. Towards the downside, we now anticipate the immediate support at 25,213 pts, which was the low of 8 Mar. The next support is likely to be at 24,862 pts, ie the previous low of 8 Feb.

As a result, we advise traders to stay short – in line with our initial recommendation to have short positions below the 25,707-pt level on 8 Mar. In the meantime, a stop-loss set above the 26,238-pt threshold is preferable to limit the risk per trade.

Source: RHB Securities Research - 13 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024