WTI Crude Futures - Revisiting the Immediate Resistance Area

rhboskres

Publish date: Wed, 13 Mar 2019, 05:39 PM

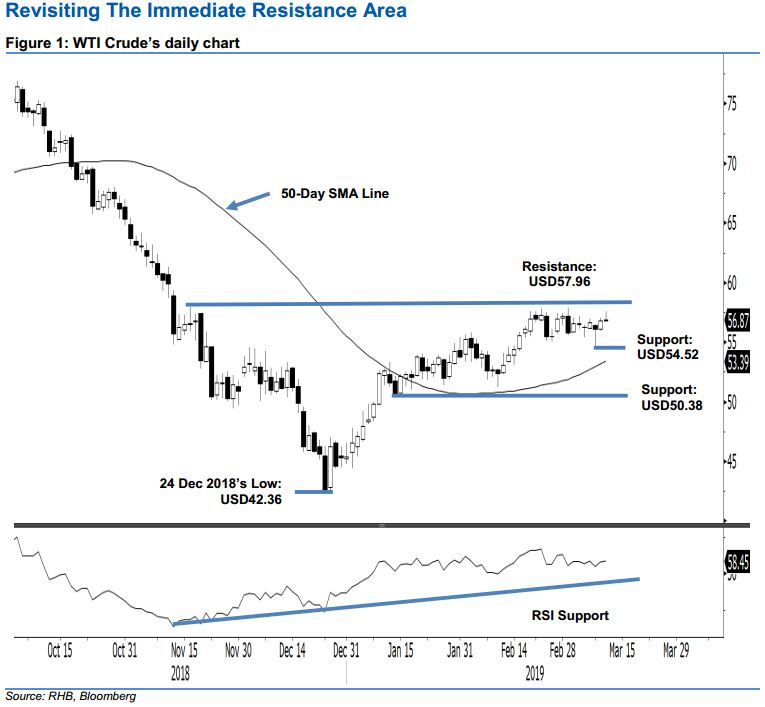

The Bulls are coming near to test the immediate resistance; maintain long positions. The WTI Crude ended marginally higher by USD0.08 to settle at USD56.87. This was after it reached a low and high of USD56.74 and USD57.55. The intraday high saw the commodity again came near to testing the immediate resistance of USD57.96. The WTI Crude has been consolidating below this resistance mark for nearly three weeks – should this mark be overcome, chances for the commodity to extend its rebound ought to improve. Towards the downside, a breach of the USD54.52 immediate support will invalidate this constructive bias. We maintain our positive trading bias

As there are no signs to suggest that the WTI Crude’s rebound has reached an end, we continue to recommend traders to maintain their long positions. These were initiated at USD49.78, or the close of 8 Jan. For riskmanagement purposes, a trailing-stop can be placed below the USD54.52 level.

The immediate support is maintained at USD54.52, the low of the latest session. This is followed by USD50.38, which was the low of 14 Jan. Conversely, the immediate resistance is maintained at USD57.96, or the high of 16 Nov 2018. This is followed by the USD60 round figure.

Source: RHB Securities Research - 13 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024