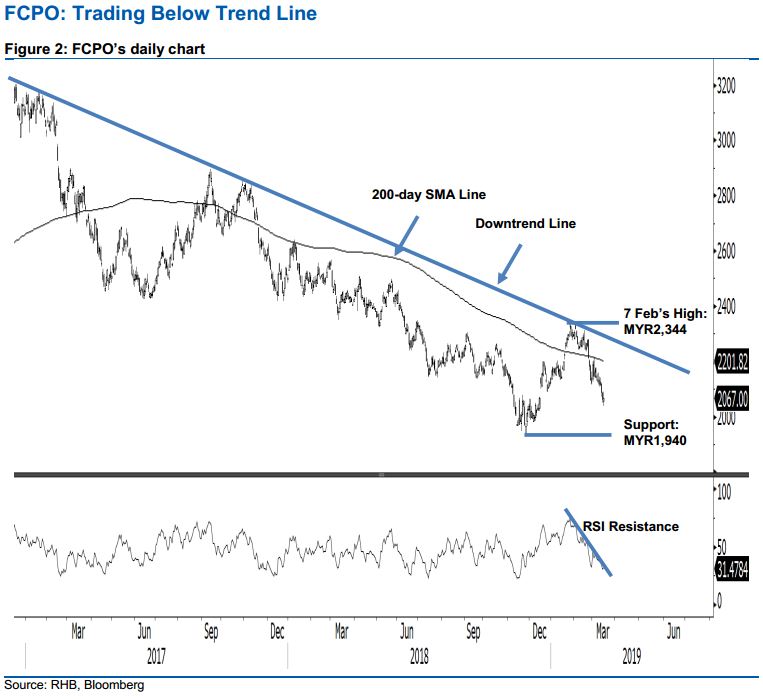

FCPO - Trading Below Trend Line

rhboskres

Publish date: Mon, 18 Mar 2019, 09:33 AM

Retracing from the long-term downtrend line; stay in short positions. We are revisiting the FCPO’s longterm price trend today. The commodity tested the downtrend line that was formed since end 2016 on 7 Feb, while the high was MYR2,344. Since then it has been retracing and, in the process, took out the 200-day SMA line and filled the 17 Dec 2018 “Upside Gap” – indicating the long-term price trend is still negative. While the Daily RSI reading is moving closer towards the oversold territory, in the absence of a price rebound or total reversal signals, we are keeping our negative trading bias.

Until there are signs that the bulls have managed to reverse the price trend, we continue to recommend that traders stay in short positions. These were initiated at MYR2,089, the closing level of 13 Mar. To manage risks, a stop-loss can be placed above MYR2,158.

The immediate support is expected at MYR1,940, the low of 27 Nov 2018. This is followed by MYR1,900, a round figure. On the other hand, the immediate resistance is set at MYR2,115, the low of 28 Feb. This is followed by MYR2,217, the high of 4 Feb.

Source: RHB Securities Research - 18 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024