WTI Crude Futures - Rebound Is Extending

rhboskres

Publish date: Tue, 19 Mar 2019, 08:55 AM

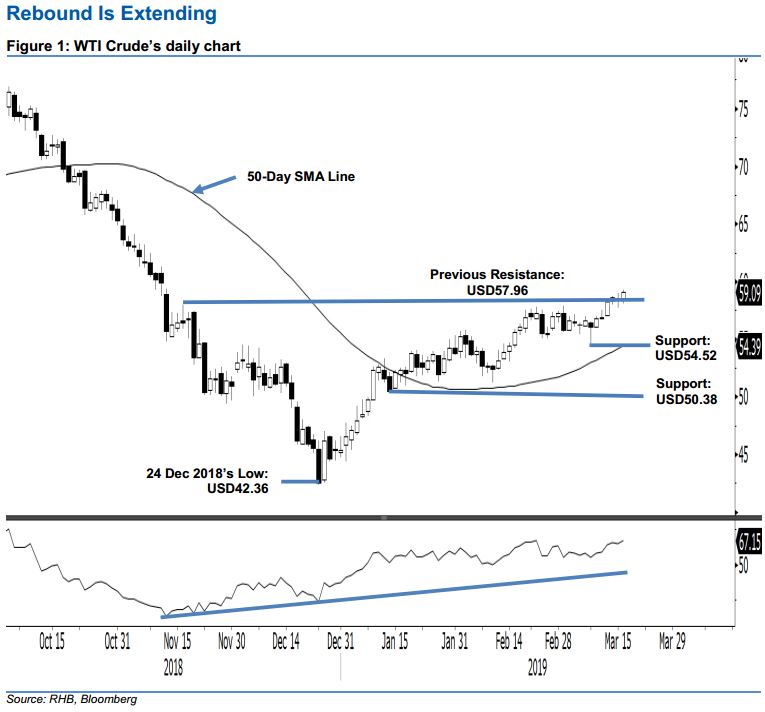

Maintain long positions as the bulls are still pushing ahead. The WTI Crude performed positively as it gained USD0.57 to close at USD59.09. The low and high were posted at USD58.05 and USD59.23. Overall, the commodity’s rebound that started from the low of USD42.96 on 24 Dec 2018 is still in place. This is further supported by the fact it managed to maintain itself above the previous immediate resistance of USD47.96 – indicating the bulls are still in control. Maintain long bias.

Given that there were no negative price actions observed around the said previous immediate resistance – to indicate possible price rejection – we continue to recommend traders maintain long positions. These were initiated at USD49.78, or the close of 8 Jan. For risk-management purposes, a trailing-stop can be placed below USD54.52.

The immediate support is maintained at USD54.52, the low of 8 Mar. This is followed by USD50.38, which was the low of 14 Jan. Conversely, the immediate resistance is revised to USD60, a round figure. The second resistance is eyed at USD63.59, which was the low of 18 Jun 2018.

Source: RHB Securities Research - 19 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024