COMEX Gold - Downside Risk Remains High

rhboskres

Publish date: Tue, 19 Mar 2019, 09:01 AM

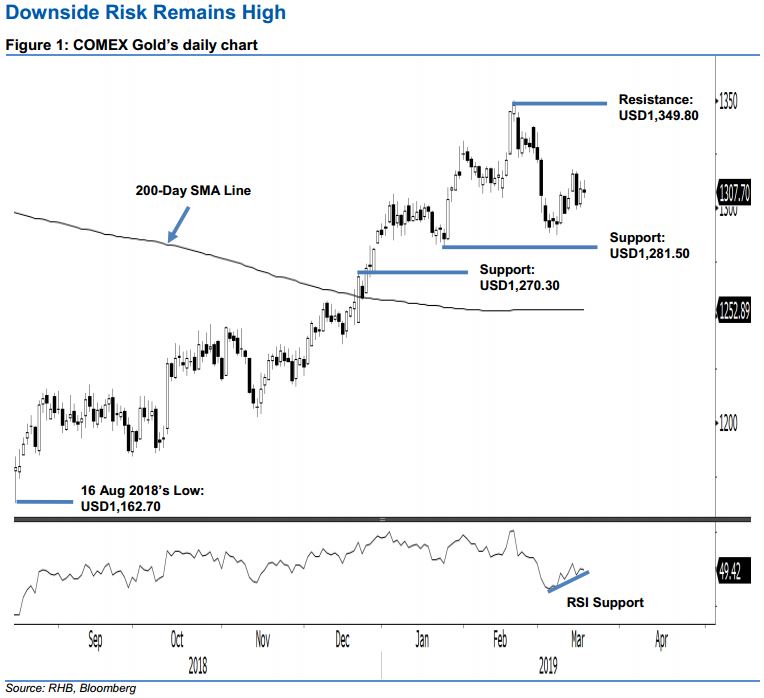

Maintain short positions as the ongoing rebound still looks corrective. The precious metal shed USD1.20 in the latest session to close at USD1,307.70. The session’s trading range was confined within USD1,304.30 and USD1,312.70. While the commodity has been rebounding over the past two weeks, the rebound is resembling the characteristics of a consolidation instead of a total price reversal. This consolidation phase set in to correct the commodity’s prior sharp retracement, which took place between 20 Feb and 7 Mar. Overall, we are still convinced that the commodity is still in the process of developing a correction phase to correct its prior multi-month’s upward move that took place between 16 Aug 2018 and 20 Feb 2019. Maintain our negative trading bias.

As we have not spotted signs that the commodity’s retracement has reached an end, we continue to recommend traders stay in short positions. These positions were initiated at USD1,322.70, which was the closing level of 1 Mar. For risk-management purposes, a stop-loss can be placed above the USD1,349.80 level.

The immediate support is expected at USD1,281.50, which was the low of 24 Jan 2018. Breaking this may see the market test USD1,270.30, or the high of 20 Dec 2018. Moving up, the immediate resistance is set at USD1,349.80, ie the high of 20 Feb. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 19 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024