E-mini Dow Futures - Moving Lower

rhboskres

Publish date: Thu, 21 Mar 2019, 05:34 PM

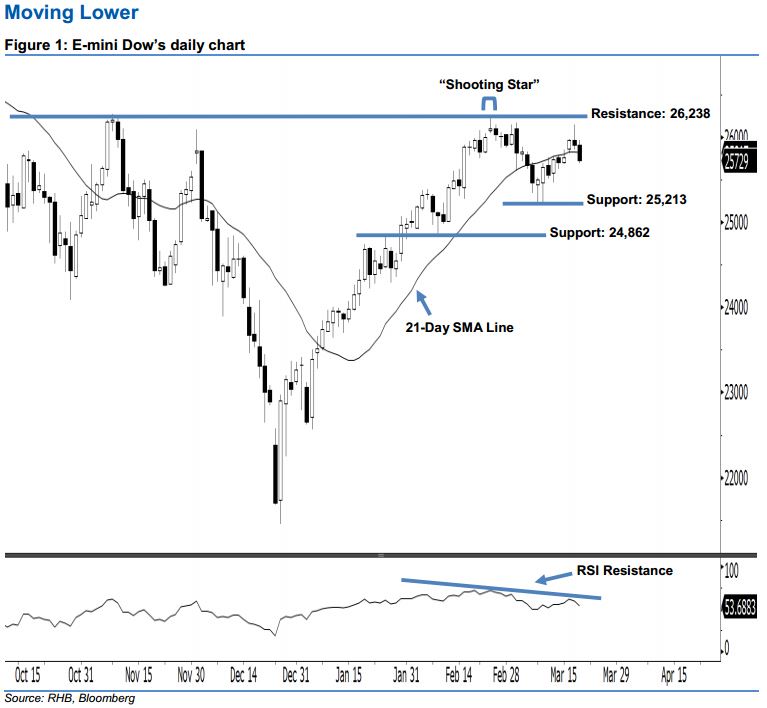

Stay short. The downward movement of the E-mini Dow continued as expected, as a black candle was formed last night. It lost 177 pts to close at 25,729 pts, off its high of 25,967 pts and low of 25,696 pts. Market sentiment is likely to remain bearish in the coming sessions, as the index posted a black candle for a second consecutive day. This may also further extend the downside swing that started with 25 Feb’s “Shooting Star” pattern. Given that the E-mini Dow has also closed below the 21-day SMA line, the bearish sentiment has been enhanced.

Based on the daily chart, we anticipate the immediate resistance at 26,238 pts, which was the high of 25 Feb’s “Shooting Star” pattern. The next resistance is maintained at the 26,966-pt historical high. Towards the downside, the immediate support is seen at 25,213 pts, obtained from the low of 8 Mar. Meanwhile, the next support is maintained at 24,862 pts, situated at the previous low of 8 Feb.

Hence, we advise traders to stay short, given that we previously recommended initiating short below the 25,707- pt level on 8 Mar. In the meantime, a stop-loss can be set above the 26,238-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 21 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024