FCPO - Eyeing a Rebound

rhboskres

Publish date: Thu, 21 Mar 2019, 05:38 PM

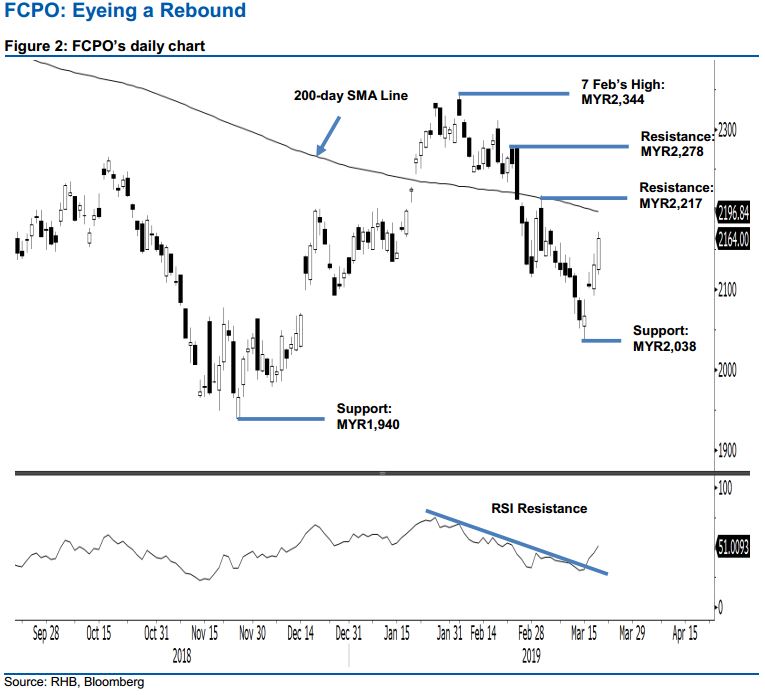

Trailing-stop triggered; initiate long positions. The FCPO formed a white candle yesterday and, at the close, crossed above our previous short positions’ trailing-stop of MYR2,158. The intraday movement was encouraging as it generally moved higher, with the low and high at MYR2,119 and MYR2,172. The commodity has been rebounding after it filled the 17 Dec 2018’s “Upside Gap” with the low of MYR2,038 on 15 Mar. Chances are now higher that it is staging a rebound to correct the recent weeks’ retracement. For now, we expect the rebound to re-challenge the 200-day SMA area – the commodity was rejected from this level on 4 Mar. We shift our trading bias to positive.

Our previous short positions, initiated at MYR2,089, the closing level of 13 Mar, were closed out in the latest session at MYR2,158. On the prospect that a rebound may be developing, we initiate long positions at the latest close. A stop-loss can be placed below MYR2,038.

The immediate support is revised to MYR2,038, the low of 15 Mar. This is followed by MYR1,940, the low of 27 Nov 2018. Conversely, the immediate resistance is expected at MYR2,217, the high of 4 Feb and near the 200- day SMA. This is followed by MYR2,278, which was the high of 25 Feb.

Source: RHB Securities Research - 21 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024