WTI Crude Futures - Swinging Near the Immediate Resistance

rhboskres

Publish date: Thu, 28 Mar 2019, 06:15 PM

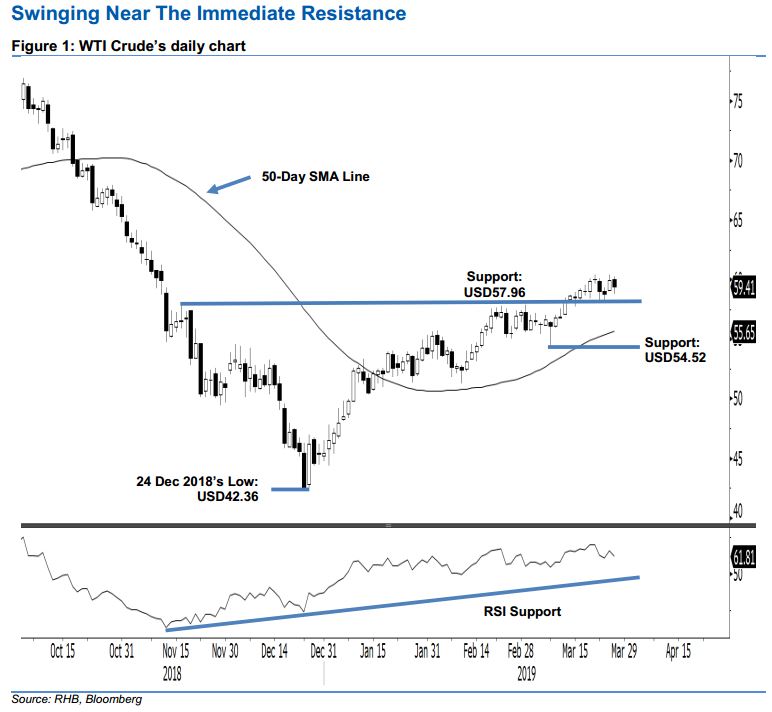

Still looks like consolidating around USD60 resistance level; maintain long positions. The WTI Crude ended on the weak side in the latest session. It closed USD0.53 softer at USD59.41, with the high and low recorded at USD60.22 and USD58.81. The recent sessions’ price actions are indicating the commodity is more likely developing a minor consolidation phase around the USD60 immediate resistance level – suggesting the overall rebound, which has been in development from the low of USD42.36 on 24 Dec 2018, remains intact. Maintain our positive trading bias.

As there are no price reversal signals spotted from the said immediate resistance level, we continue to recommend traders stay in long positions. These were initiated at USD49.78, or the close of 8 Jan. For riskmanagement purposes, a trailing-stop can now be placed below the USD58.17 level, ie the low of 25 Mar.

Towards the downside, immediate support is expected at USD57.96, which was the high of 16 Nov. The second support is eyed at USD54.52, or the low of 8 Mar. On the other hand, the overhead resistance is eyed at USD60 – a round figure. This is followed by USD63.59, which was the low of 18 Jun 2018.

Source: RHB Securities Research - 28 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024