Hang Seng Index Futures - Bullish Sentiment Stays Intact

rhboskres

Publish date: Tue, 02 Apr 2019, 09:31 AM

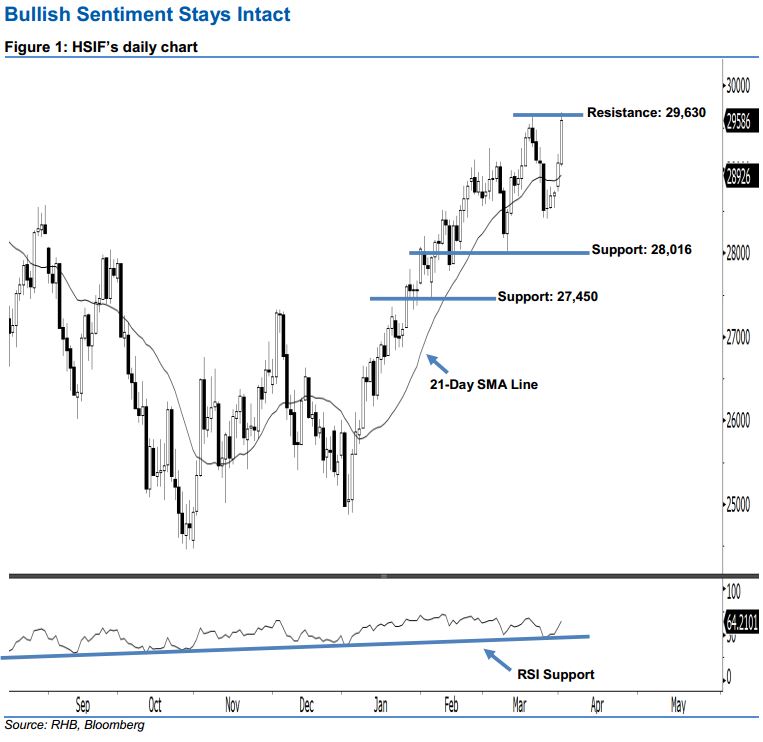

Uptrend is likely to continue; stay long. The HSIF formed a long white candle yesterday – an indication of a strong buying momentum. It surged 509 pts to close at 29,586 pts, off the session’s low of 29,034 pts and high of 29,681 pts. On a technical basis, we expect the rebound that started in early-January to likely continue. This is because the HSIF has marked a higher close vis-à-vis the previous sessions since 26 Mar. With the 21-day SMA line edging upwards, this has led us to believe that the index’s bullish trend remains intact.

Based on the daily chart, we anticipate the immediate support at 28,016 pts, which was determined from the low of 11 Mar. If a breakdown arises, look to 27,450 pts – ie the low of 8 Feb – as the next support. To the upside, we are eyeing the immediate resistance at 29,630 pts, which was the high of 20 Mar. Meanwhile, the next resistance will likely be at the 30,000-pt psychological spot.

As a result, we advise traders to stay long, following our recommendation of initiating long above the 29,039-pt level on 20 Mar. A stop-loss can be set below the 28,016-pt mark to limit the downside risk.

Source: RHB Securities Research - 2 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024