Hang Seng Index Futures - Rally Continues

rhboskres

Publish date: Thu, 04 Apr 2019, 04:46 PM

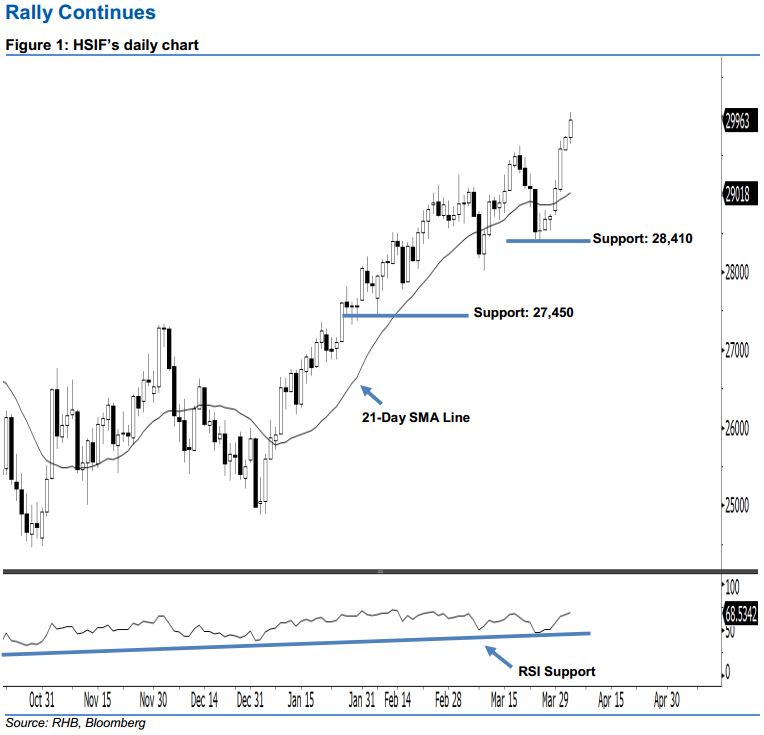

Stay long, with a trailing-stop set below the 28,410-pt support. The upward movement of the HSIF has continued as expected, as another white candle was formed yesterday. It rose to a high of 30,059 pts during the intraday session, before ending at 29,963 pts for the day. Market sentiment remains bullish, as the aforementioned white candle was the sixth one in six consecutive sessions. In addition, the 14-day RSI indicator is now rising higher without being overbought, enhancing the bullish sentiment. Overall, we keep our bullish view on the HSIF’s outlook.

As seen in the chart, the immediate support level is seen at 28,410 pts, ie the previous low of 26 Mar. Meanwhile, the next support would likely be at 27,450 pts, obtained from the low of 8 Feb. Towards the upside, we maintain the near-term resistance level at the 30,000-pt psychological spot. This is followed by 31,544 pts, defined from the previous high of 7 Jun 2018.

Thus, we advise traders to stay long, following our recommendation of initiating long above the 29,039-pt level on 20 Mar. A trailing-stop can be set below the 28,410-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 4 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024