E-mini Dow Futures - Moving Higher

rhboskres

Publish date: Fri, 05 Apr 2019, 05:13 PM

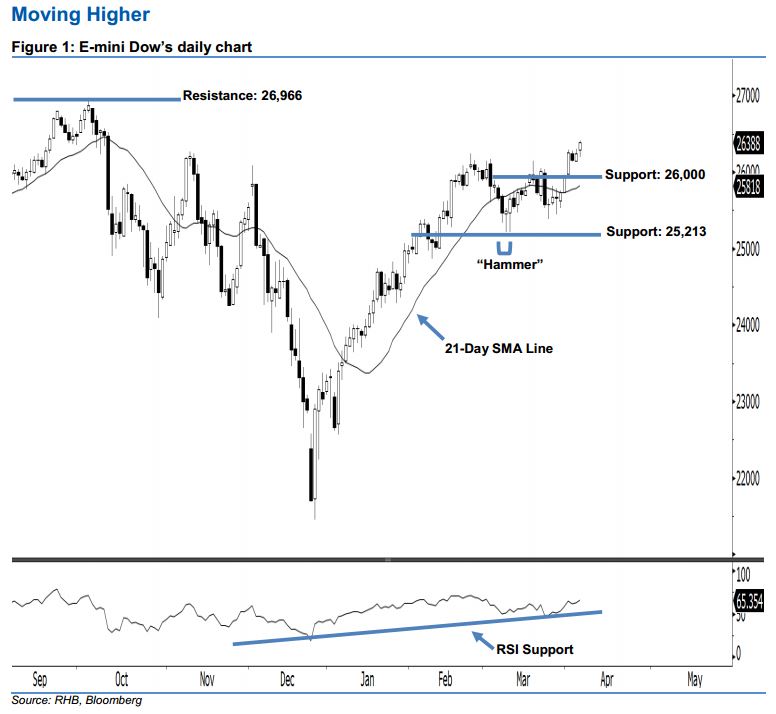

Stay long while setting a stop-loss below the 25,213-pt support. The upside strength of the E-mini Dow continued as expected, as a white candle was formed last night. It gained 148 pts to close at 26,388 pts, off the session’s high of 26,410 pts. Market sentiment remains bullish, as the index has posted a white candle for a second consecutive day. This may also further extend the rebound that started with 8 Mar’s “Hammer” pattern. In view that the 21-day SMA line is likely to turn higher, the bullish sentiment has therefore been enhanced.

According to the daily chart, the immediate support level is maintained at the 26,000-pt psychological spot. The next support would likely be at 25,213 pts, ie the low of 8 Mar’s “Hammer” pattern. Towards the upside, the immediate resistance level at is seen at the 26,966-pt record high. The next resistance is anticipated at the 27,000-pt round figure.

Thus, we advise traders to maintain long positions, following our recommendation of initiating long above the 26,000-pt level on 2 Apr. In the meantime, a stop-loss can be set below the 25,213-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 5 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024