FCPO - Nearing The Immediate Resistance

rhboskres

Publish date: Fri, 05 Apr 2019, 05:29 PM

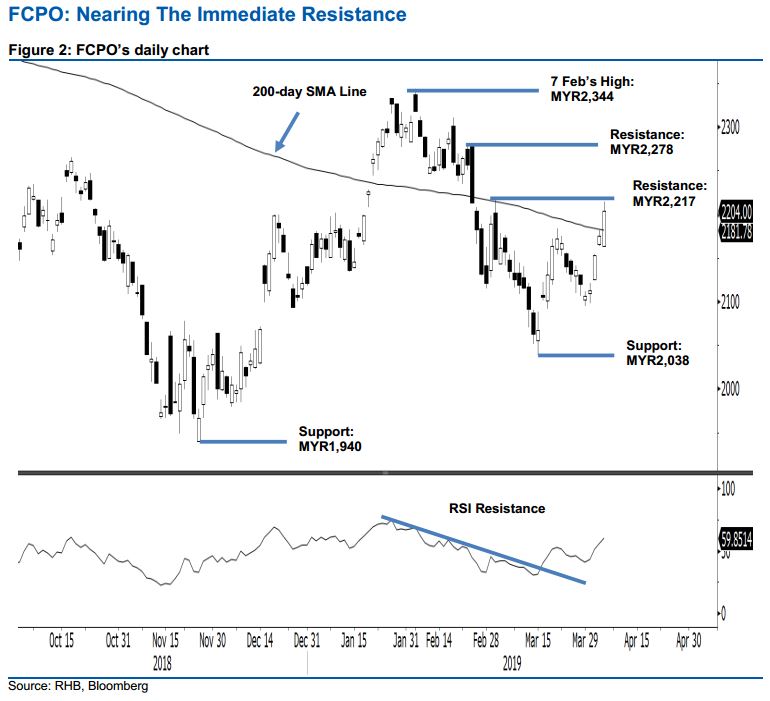

Bulls are pushing towards the immediate resistance; maintain long positions. The FCPO formed another white candle in the latest trading, and in the process, came in near to test the immediate resistance of MYR2,217. The session’s low and high were at MYR2,164 and MYR2,214, before ending at MYR2,204, indicating a gain of MYR30. The closing level has also placed the commodity slightly above the 200-day SMA line – a valid breach would only be confirmed should the said immediate resistance is taken out. The recent sessions’ rally is still considered healthy, given the daily RSI reading of 59.9. Maintain positive trading bias.

As the commodity continued to show resiliency around the 200-day SMA line, we continue to recommend that traders stay in long positions. These were initiated at MYR2,164, the closing level of 21 Mar. A stop-loss can now be placed at the breakeven level.

We are still pegging the immediate support at MYR2,038, the low of 15 Mar, followed by MYR1,940, the low of 27 Nov 2018. Conversely, the immediate resistance is set at MYR2,217, the high of 4 Feb. This is followed by MYR2,278, or 25 Feb’s high.

Source: RHB Securities Research - 5 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024