FKLI - a Minor Bounce

rhboskres

Publish date: Tue, 03 Dec 2019, 09:46 AM

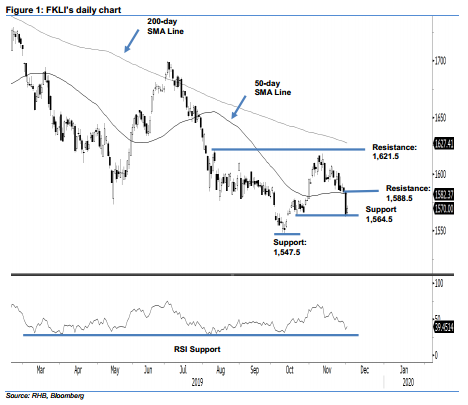

No price reversal signal yet; maintain short positions. The FKLI formed a white candle to settle the session 4.5 pts higher at 1,570 pts. Trading ranged between 1,564 pts and 1,572 pts. The positive session came after the index tested the immediate support of 1,564.5 pts in the prior session. However, it was not strong enough to signal a price reversal signal. All in, the index’s correction phase, which started from the failed attempt to cross the 1,621.5 pts resistance is still in place – this is further supported by the fact that it is trading below the 50-day SMA line. Maintain our negative trading bias.

As the bears are still having control over the said multi-week correction phase, we recommend traders to stay in short positions. We initiated these at 1,564 pt, the closing level of 29 Nov. To manage risks, a stop-loss can set above 1,588.5 pts.

The immediate support target is set at 1,564.5 pts, the low of 21 Oct, followed by 1,547.5 pts, the low of 10 Oct. Towards the upside, the immediate resistance is expected to emerge at 1,588.5 pts, the high of 29 Nov. This is followed by 1,621.5 pts, the high of 9 Aug.

Source: RHB Securities Research - 3 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024