FKLI - Deeper-Than-Expected Correction

rhboskres

Publish date: Mon, 02 Dec 2019, 10:29 AM

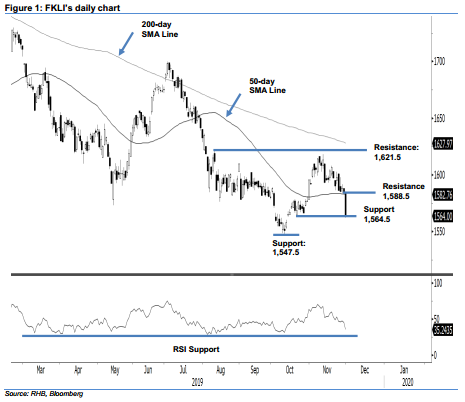

Initiate short positions as the correction is deeper than expected. The FKLI formed a black candle in the latest session – crossing below the 50-day SMA line in the process. The session’s low and high were recorded at 1,562 pts and 1,585 pts, before closing at 1,564 pts, indicating a decline of 20.5 pts. The downside breach of the said SMA means the multi-week correction phase, which started from the failed attempt to cross above the 1,621.5-pt resistance, is still in place and deeper than expected. This also means the countertrend rebound that we highlighted recently has probably reached an interim top. Switch our trading bias to negative.

Our previous long positions initiated at 1,565 pts, the closing level of 14 Oct, were closed out at breakeven in the latest session. On the bias that the retracement from the failed attempt to cross above 1,621.5 pts is still developing, we initiate short positions at the latest closing. To manage risks, a stop-loss can set above 1,588.5 pts.

The immediate support target is still set at 1,564.5 pts, the low of 21 Oct, as it was not decisively breached in the latest session, followed by 1,547.5 pts, the low of 10 Oct. Towards the upside, the immediate resistance is now set at 1,588.5 pts, the high of the latest session. This is followed by 1,621.5 pts, the high of 9 Aug.

Source: RHB Securities Research - 2 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024