Hang Seng Index Futures - Charts Another Black Candle

rhboskres

Publish date: Thu, 05 Dec 2019, 05:07 PM

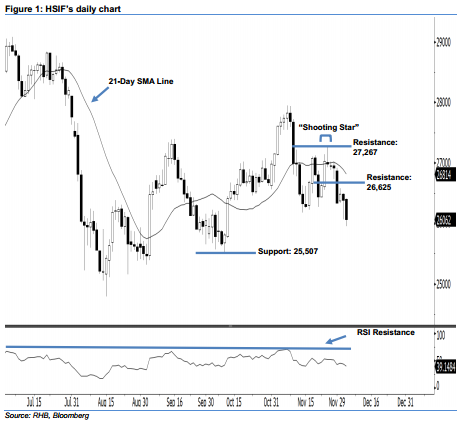

Stay short, with a trailing-stop set above the 27,267-pt resistance. The downside move of the HSIF continued as expected, as a black candle was formed yesterday. It settled at 26,062 pts, off its high of 26,413 pts. As the index has marked a lower close below the declining 21-day SMA line, this can be viewed as the bears expanding their downward momentum. In view that the HSIF has posted a black candle for the second consecutive day, this indicates the downside swing, which began with 26 Nov’s “Shooting Star” pattern, may go on.

Judging from the current outlook, the immediate resistance level is anticipated at 26,625 pts, which is set near the midpoint of 29 Nov’s long black candle. Meanwhile, the crucial resistance is maintained at 27,267 pts – this was determined from the high of 26 Nov’s “Shooting Star” pattern. Towards the downside, we are now eyeing the immediate support level at the 26,000-pt psychological spot. If a decisive breakdown arises, look to 25,507 pts – the previous low of 10 Oct – as the next support.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 26,630-pt level on 22 Nov. In the meantime, a trailing-stop set above the 27,267-pt mark is preferable to minimise the risk per trade.

Source: RHB Securities Research - 5 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024