E-mini Dow Futures - Triggers Long Positions

rhboskres

Publish date: Tue, 17 Dec 2019, 10:12 AM

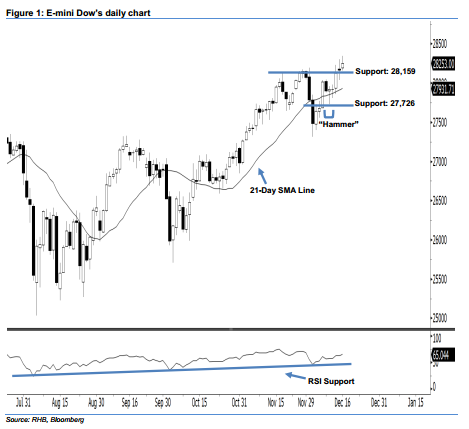

Initiate long positions above the 28,159-pt level. The E-mini Dow formed a white candle last night. It rose 85 pts to close at 28,253 pts, off its high of 28,345 pts and low of 28,159 pts. As the index recorded a higher close above the rising 21-day SMA line and hit its new record-high, this indicates that market sentiment is turning positive. Yesterday’s white candle can be viewed as a continuation of the bulls extending the rebound from 10 Dec’s “Hammer” pattern. This close has also triggered our stop-loss, which we previously recommended investors set at the 28,197-pt threshold.

According to the daily chart, we now anticipate the immediate support level at 28,159 pts, ie the low of 16 Dec. The next support is seen at 27,726 pts, which was the low of 10 Dec’s “Hammer” pattern. On the other hand, the nearterm resistance level is set at the 28,500-pt round figure. This is followed by the 29,000-pt psychological mark.

Therefore, we advise traders to initiate fresh long positions above the 28,159-pt level. At the same time, a stop-loss can be set below the 27,726-pt threshold to minimise the downside risk.

Source: RHB Securities Research - 17 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024