COMEX Gold - Trend Is Still Negative

rhboskres

Publish date: Wed, 18 Dec 2019, 05:53 PM

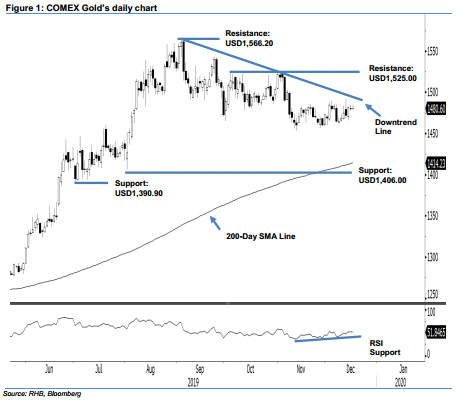

No clear sign for a change in trend; maintain short positions. The COMEX Gold closed the latest session marginally higher by USD0.10 to settle at USD1,480.60. This was after it swung between a low and high of USD1,478.10 and USD1,484.90. The precious metal’s price actions over the recent weeks indicate the bears are taking a breather – once this is completed, the correction phase that started from the high of USD1,566.20 on 4 Sep would likely extend. Adding support to our negative trading bias is that the commodity is still capped by the downtrend line, as drawn on the chart.

As the recent weeks’ rebound is not signalling an end to the commodity’s correction phase, we advise traders to stay in short positions. We initiated these at USD1,464.10, or the closing level of 11 Nov. For risk-management purposes, a stop-loss can be placed above the USD1,525.00 threshold.

The immediate support is expected to emerge at the USD1,406.00 mark, ie near the low of 1 Aug. This is followed by USD1,390.90, or the low of 1 Jul. On the other hand, the immediate resistance is set at USD1,525.00, ie the high of 3 Oct. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 18 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024