RHB Retail Research

Hang Seng Index Futures - the Sentiment Remains Bullish

rhboskres

Publish date: Mon, 23 Dec 2019, 08:42 AM

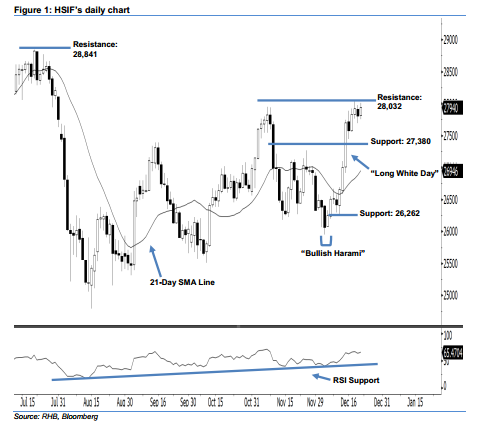

Stay long, with a trailing-stop set below the 27,380-pt support. The HSIF formed a white candle last Friday. During the intraday session, it rose to a high of 28,014 pts before ending at 27,940 pts for the day. From a technical perspective, we believe the buyers may have retained control of the market. This was as last Friday’s white candle recouped the previous sessions’ losses and marked a higher close above the rising 21-day SMA line. Meanwhile, last Friday’s higher close can also be viewed as a continuation of the bulls extending the rebound from 5 Dec’s “Bullish Harami” pattern.

Based on the daily chart, the immediate support level is seen at 27,380 pts, which is situated near the midpoint of 13 Dec’s “Long White Day” candle. The next support is anticipated at 26,262 pts, or determined from the low of 11 Dec. To the upside, we maintain the immediate resistance level at 28,032 pts, ie the high of 18 Dec. If a breakout arises, look to 28,841 pts – the previous high of 19 Jul – as the next resistance.

Thus, we advise traders to stay long, following our recommendation of initiating long above the 26,500-pt level on 12 Dec. A trailing-stop can be set below the 27,380-pt mark to lock in part of the profits.

Source: RHB Securities Research - 23 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments