RHB Retail Research

FKLI - Buying Momentum Resumes

rhboskres

Publish date: Mon, 30 Dec 2019, 10:49 AM

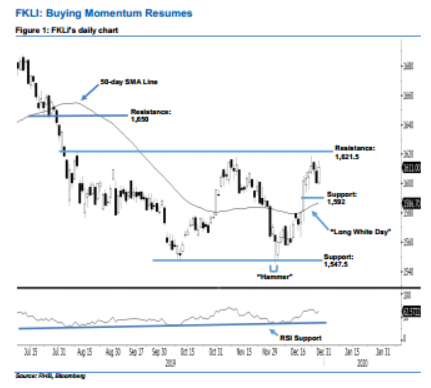

Stay long while setting a trailing-stop below the 1,592-pt support. After forming two black candles in a row, the FKLI ended higher to form a white candle last Friday. It rose 10.50 pts to close at 1,611 pts, off the session’s low of 1,599.50 pts. Based on the current outlook, we think the buyers may have regained control of the market. This was as last Friday’s white candle has recouped the previous session’s losses. Given that the FKLI is still trading above the rising 50-day SMA line, this implies that the rebound that started from 3 Dec’s “Hammer” pattern may carry on. Overall, we remain upbeat on the FKLI’s outlook.

As shown in the chart, we are eyeing the immediate support level at 1,592 pts, situated near the midpoint of 18 Dec’s “Long White Day” candle. If this level is taken out, the next support is seen at 1,547.50 pts, which was the previous low of 10 Oct. On the other hand, the immediate resistance level is maintained at 1,621.50 pts, defined from the high of 9 Aug. The next resistance would likely be at the 1,650-pt round figure.

Therefore, we advise traders to stay long, in line with our initial recommendation to have long positions above the 1,568-pt level on 9 Dec. A trailing-stop set below the 1,592-pt threshold is advisable to lock in part of the profits.

Source: RHB Securities Research - 30 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments