RHB Retail Research

FCPO - Approaching a 2-Year High

rhboskres

Publish date: Mon, 30 Dec 2019, 10:51 AM

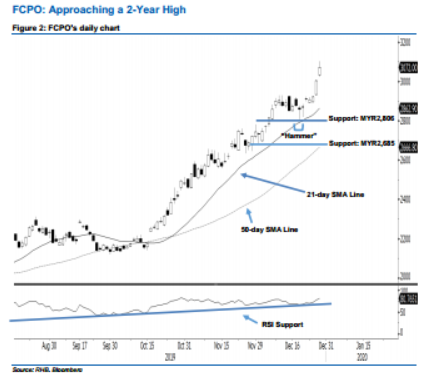

Bullish trend is likely to continue; stay long. The FCPO’s upside strength continued as expected after it ended higher and left an upside gap last Friday. It gained MYR67 to close at MYR3,072, after oscillating between a high of MYR3,103 and low of MYR3,024. As the commodity has marked a higher close vis-à-vis the previous sessions since 24 Dec, this can be viewed as the bulls extending their buying momentum. Furthermore, in view of the positive slopes of the 21-day and 50-day SMA lines, these suggest that additional strength may be present in the coming sessions.

According to the daily chart, we anticipate the immediate support level at MYR2,806, which was the low of 18 Dec’s “Hammer” pattern. The next support is seen at MYR2,685, ie the low of 2 Dec. Towards the upside, the immediate resistance level is now situated at MYR3,202, obtained from the previous high of 19 Dec 2016. Meanwhile, the next resistance is anticipated at the MYR3,300 psychological mark.

Thus, we advise traders to maintain long positions, given we had initially recommended initiating long above the MYR2,175 level on 9 Oct. In the meantime, a trailing-stop can be set below the MYR2,806 threshold in order to secure part of the gains.

Source: RHB Securities Research - 30 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments