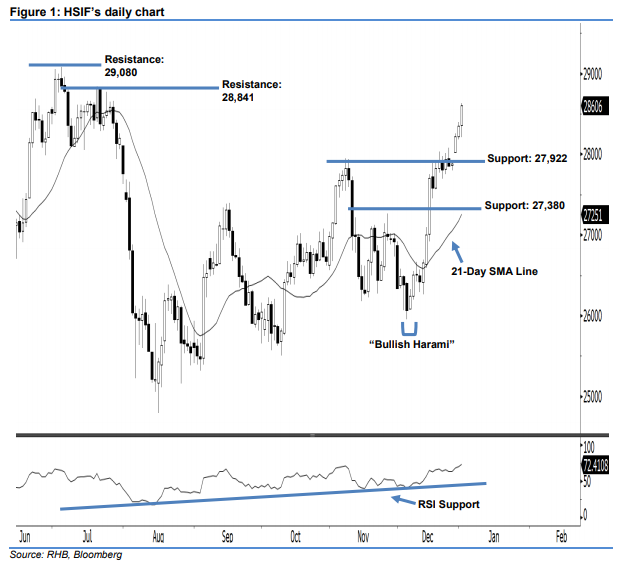

Hang Seng Index Futures: Another White Candle

rhboskres

Publish date: Fri, 03 Jan 2020, 05:04 PM

Stay long. The upward movement of the HSIF has continued as expected, as another white candle was formed yesterday. It closed at 28,606 pts, after oscillating between a high of 28,631 pts and low of 28,211 pts. The market trend remains bullish, as the aforementioned white candle was the third one in three consecutive sessions. Furthermore, the index has marked a higher close above the rising 21-day SMA line, which can be viewed as the buyers extending the upside momentum. Overall, we believe the bullish outlook remains intact. As seen in the chart, we are eyeing the immediate support level at 27,922 pts, ie the upside gap support of 27 Dec 2019. The next support will likely be at 27,380 pts, which is set near the midpoint of 13 Dec 2019’s long white candle. To the upside, the immediate resistance level is seen at 28,841 pts – this was obtained from the high of 19 Jul 2019. The next resistance is maintained at 29,080 pts, which was the previous high of 4 Jul 2019. Hence, we advise traders to maintain long positions, since we originally recommended initiating long above the 26,500-pt level on 12 Dec 2019. A trailing-stop set below the 27,922-pt threshold is advisable to secure part of the gains.

Source: RHB Securities Research - 3 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024