WTI Crude Futures - 200-Day SMA Still Being Tested

rhboskres

Publish date: Thu, 16 Jan 2020, 09:53 AM

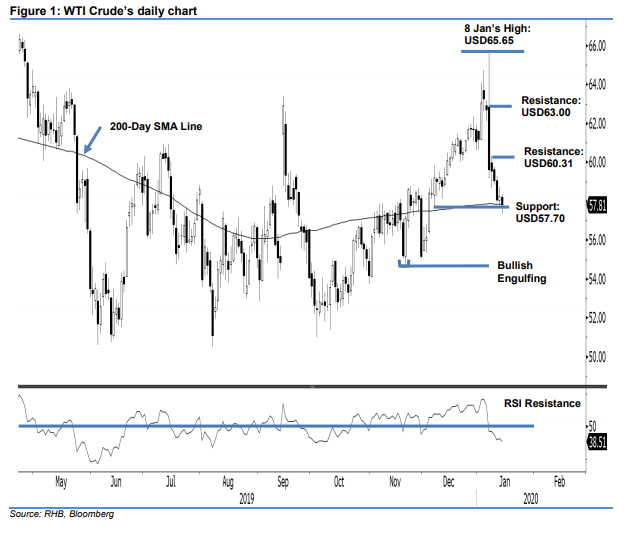

Maintain short positions as supports are under pressure. The WTI Crude tested both the 200-day SMA line and the immediate support of USD57.70 in the latest session. At one point it reached a low of USD57.36, before settling USD0.42 weaker at USD57.81. Price actions around the said support and the SMA line in the coming sessions are critical in signalling its next directional bias, ie a firm rebound could potentially mark an interim low, while a downside breach could mean further retracement risk. For now, we keep to our negative trading bias.

In absence of signals of bears running out of steam, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can be placed at the breakeven level.

We are keeping the immediate support at USD57.70, which is near the 200-day SMA line. This is followed by the USD54.76 mark, or the low of 20 Nov 2019’s “Bullish Engulfing” pattern. Moving up, the immediate resistance is set at USD60.31, the high of 9 Jan. This is followed by USD63.00, ie near the middle of 8 Jan’s candle.

Source: RHB Securities Research - 16 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024