WTI Crude Futures - Minor Bounce

rhboskres

Publish date: Wed, 29 Jan 2020, 05:15 PM

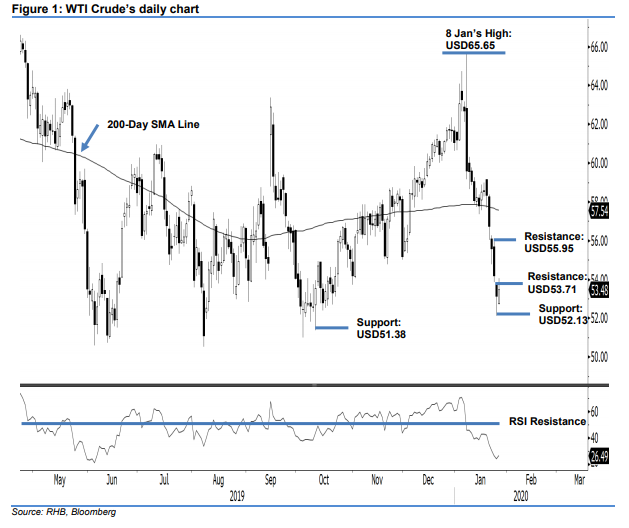

No reversal signal; maintain short positions. The WTI Crude halted its multi-session decline in the latest trade, adding USD0.34 to close at USD53.48. At one point, it tested the immediate resistance of USD53.71 with an intraday high of USD54.06. The positive session was not sufficient to generate a price reversal signal, and can be seen as just a minor pause after the recent declines which saw the RSI fall into an oversold threshold. Until there are additional positive price actions to signal an interim low is in place, we are keeping our negative trading bias.

In the absence of a positive price reversal signal, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD55.95 mark.

Immediate support is maintained at USD52.13, the latest low, followed by USD51.38, the low of 10 Oct 2019. Moving up, the immediate resistance is now eyed at USD53.71, the latest high. This is followed by USD55.95, the high of 24 Jan.

Source: RHB Securities Research - 29 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024