FKLI - Countertrend Rebound Ends

rhboskres

Publish date: Wed, 29 Jan 2020, 05:18 PM

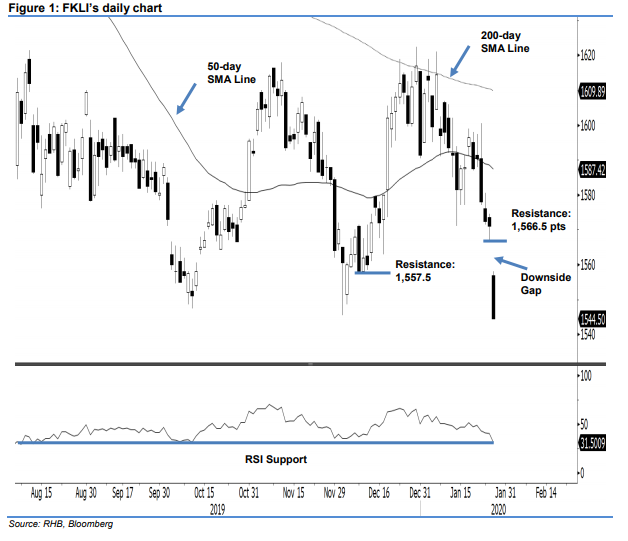

Initiate short positions as the downtrend is likely to resume. The FKLI opened the session with a “Downside Gap” – at the close, it settled below the 10 Oct 2019’s low of 1,547.5 pts at 1,544.5 pts, indicating a 26.5 pts decline. The negative session signalled the multi-month countertrend rebound, which started from the said 10 Oct 2019’s low, has reached an end after the index failed to cross above the 200-day SMA line during the said rebound phase. This means chances are high that the downtrend that started from Apr 2018 has resumed. Hence, we now switch our trading bias to negative.

Our previous long positions initiated at 1,568 pts, the closing level of 6 Dec 2019, were closed out at the latest session. On the bias that the long-term downtrend has resumed, we initiate short positions at the latest close. To manage risks, a stop-loss can be placed above 1,566.5 pts.

The immediate support is revised to 1,538.5 pts, the low of 7 Sep 2015, followed by the 1,500-pt mark. Towards the upside, the immediate resistance is now pegged at 1,557.5 pts, the lows of 9 and 10 Dec 2019, this is followed by 1,566.5 pts, the low of 24 Jan.

Source: RHB Securities Research - 29 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024