FCPO - Long Black Candle Emerges

rhboskres

Publish date: Wed, 29 Jan 2020, 05:19 PM

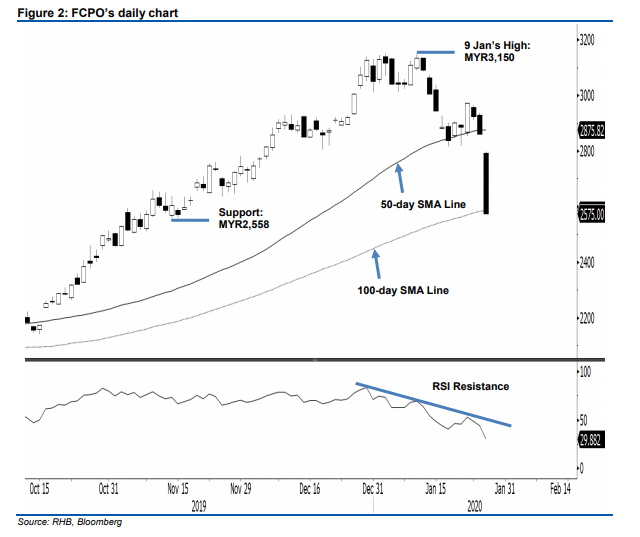

Initiate short positions as the rebound is shorter than expected. The FCPO formed a long black candle in the latest trade to pierce through both the previous immediate support of MYR2,816 and the 50-day SMA line. At the close, the commodity settled MYR286 lower at MYR2,575. The weak session invalidated our previous expectation for the commodity to extend its rebound. This implies chances are high it is resuming its correction phase that started from recent failed attempts to cross above the MYR3,150 level. Premised on this, we switch our trading bias to negative.

Our previous long positions initiated at MYR2,973, the closing level of 22 Jan, were closed out in the latest session. On the bias that the commodity is resuming its retracement, we initiate short positions at the latest close. To manage risk, a stop-loss can be placed above MYR2,619.

The immediate support is revised to MYR2,558, the low of 14 and 15 Nov 2019, this is followed by MYR2,500 – a round figure. Meanwhile, the immediate resistance is set at MYR2,619, this is followed by MYR2,650 – both are derived from the latest session’s candle.

Source: RHB Securities Research - 29 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024