FKLI - Minor Bounce

rhboskres

Publish date: Thu, 30 Jan 2020, 05:20 PM

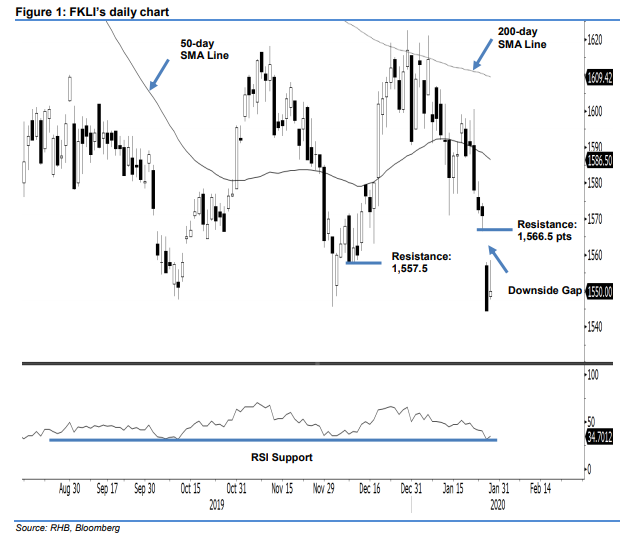

Maintain short positions as the trend is still negative. The FKLI closed 5.5 pts higher, at 1,550 pts, yesterday. At one point, it tested the immediate resistance of 1,557.5 pts with an intraday high of 1,558.5 pts. The positive session did not alter the index’s overall negative bias and it can be seen as just minor pause by the bears after the previous session’s relatively sharp decline – more so as it failed to maintain most of its intraday gains. Overall, we still think the previous multi-month countertrend rebound has ended, with attempts to cross the 200-day SMA line having failed. Hence, we stay with our negative trading bias.

As the downtrend is likely to be extended, we continue to advise traders to stay in short positions. We initiated these at 1,522.5 pts, the closing level of 28 Jan. To manage risks, a stop-loss can be placed above 1,566.5 pts.

The immediate support is maintained at 1,538.5 pts, the low of 7 Sep 2015, followed by the 1,500-pt mark. Meanwhile, the immediate resistance is expected at 1,557.5 pts, the lows of 9 and 10 Dec 2019, this is followed by 1,566.5 pts, the low of 24 Jan.

Source: RHB Securities Research - 30 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024