FCPO - Reaches Stop-Loss Point

rhboskres

Publish date: Thu, 30 Jan 2020, 05:22 PM

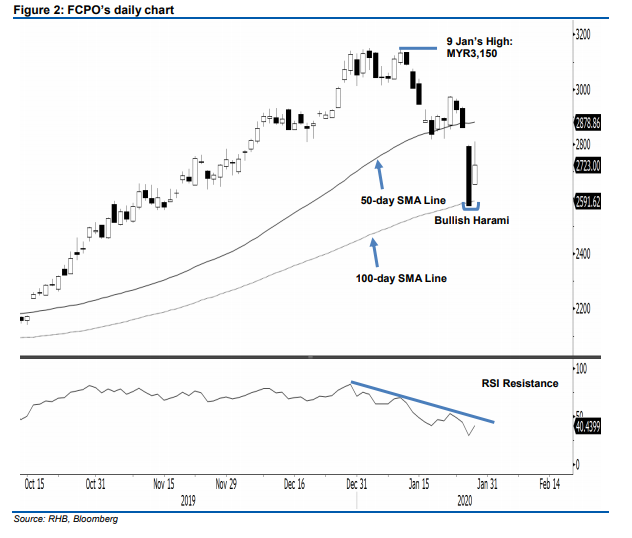

Initiate long positions. The FCPO staged a strong positive session yesterday, after the prior session’s sharp decline. In the process, it crossed above the previous two resistance levels. The session’s low and high were at MYR2,653 and MYR2,810. The commodity closed MYR148 stronger, at MYR2,723. A “Bullish Harami” formation also emerged. The strong session is a positive reaction after the FCPO tested the 100-day SMA line in the prior session, which indicates that a rebound may be taking place after the prior session’s sharp decline sent the RSI into an oversold reading. As such, we switch our trading bias to a positive one.

Our previous short positions, initiated at MYR2,575, were closed in the latest session. As a rebound is likely developing, we initiate long positions at the latest close. To manage risks, a stop-loss can be placed below MYR2,653.

The immediate support is revised to MYR2,653, the latest session’s low, followed by MYR2,575, the low of 28 Jan. Conversely, the immediate resistance is set at MYR2,753, this is followed by MYR2,810 – both are derived from the latest session’s candle.

Source: RHB Securities Research - 30 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024