WTI Crude Futures - Bears Testing the Immediate Support

rhboskres

Publish date: Fri, 31 Jan 2020, 05:18 PM

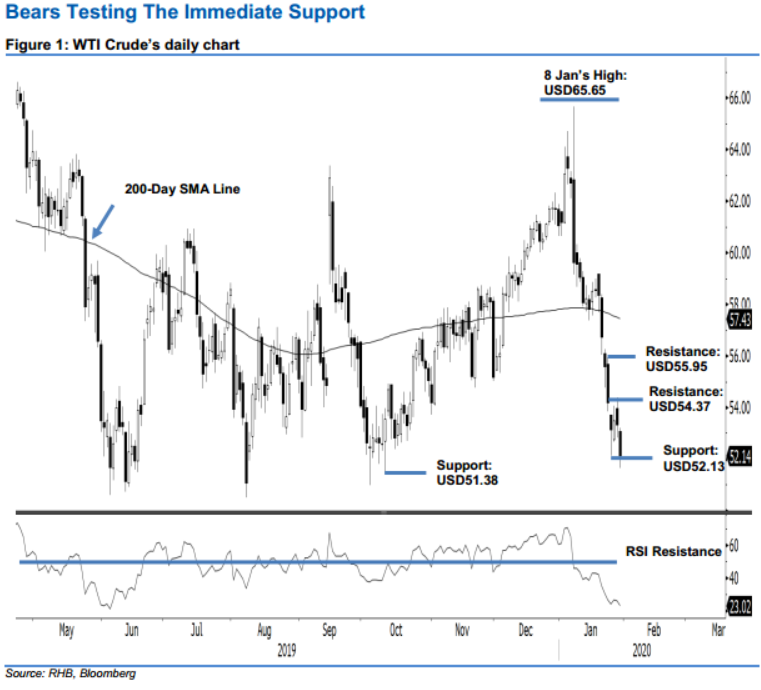

Maintain short positions, as there are still no reversal signs despite being oversold. The WTI Crude tested the USD52.13 immediate support on a relatively wide trading range of USD51.66 and USD53.20, before closing USD1.19 weaker at USD52.14. The weak performance can be seen as an extension of the downward moves that started from the high of USD65.65, which was recorded on 8 Jan. This negative bias was further enhanced recently after the commodity slipped below the 200-day SMA line. While the RSI reading is flashing out an oversold signal, in the absence of any price-reversal signals, we stay with our negative trading bias.

As the bears are still in firm control over the price trend, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD55.95 mark.

The immediate support is maintained at USD52.13, or the low of 27 Jan. This is followed by USD51.38, ie the low of 10 Oct 2019. Meanwhile, the immediate resistance is revised to USD54.37, the high of 29 Jan. This is followed by USD55.95, or the high of 24 Jan.

Source: RHB Securities Research - 31 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024