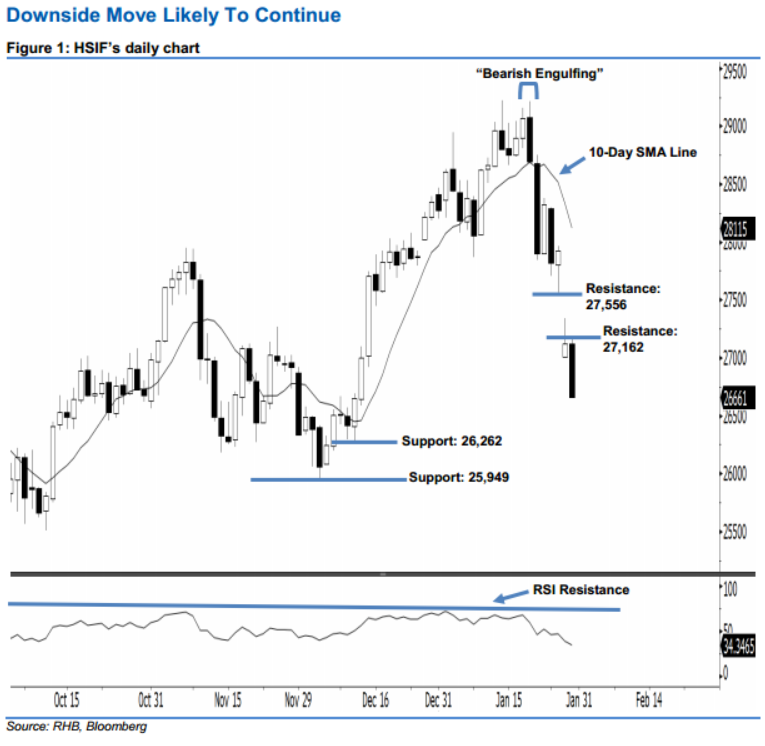

Hang Seng Index Futures - Downside Move Likely to Continue

rhboskres

Publish date: Fri, 31 Jan 2020, 06:13 PM

Stay short while setting a new trailing-stop above the 27,162-pt level. The selling momentum in the HSIF has continued on as expected, as a long black candle was formed yesterday. This points towards a continuation of the downside move. The index lost 464 pts to close at 26,661 pts. Market outlook remains bearish, as the HSIF has hit its lowest point in 1.5 months. As the 14-day RSI indicator deteriorated to a weaker reading at 34.34 pts, this indicates that the downside swing that began off 20 Jan’s “Bearish Engulfing” pattern may carry on.

Currently, the immediate resistance level is seen at 27,162 pts, ie the high of 30 Jan’s long black candle. The next resistance is anticipated at 27,556 pts, determined from the downside gap resistance of 29 Jan. Towards the downside, the near-term support level is situated at 26,262 pts, ie 11 Dec 2019’s low. This is followed by 25,949 pts, which was the previous low of 4 Dec 2019.

To re-cap, on 22 Jan, we initially recommended traders to initiate short below the 28,300-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 27,162-pt mark. This is in order to secure a larger part of the profits.

Source: RHB Securities Research - 31 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024