E-mini Dow Futures - Sentiment Remains Negative

rhboskres

Publish date: Fri, 31 Jan 2020, 06:15 PM

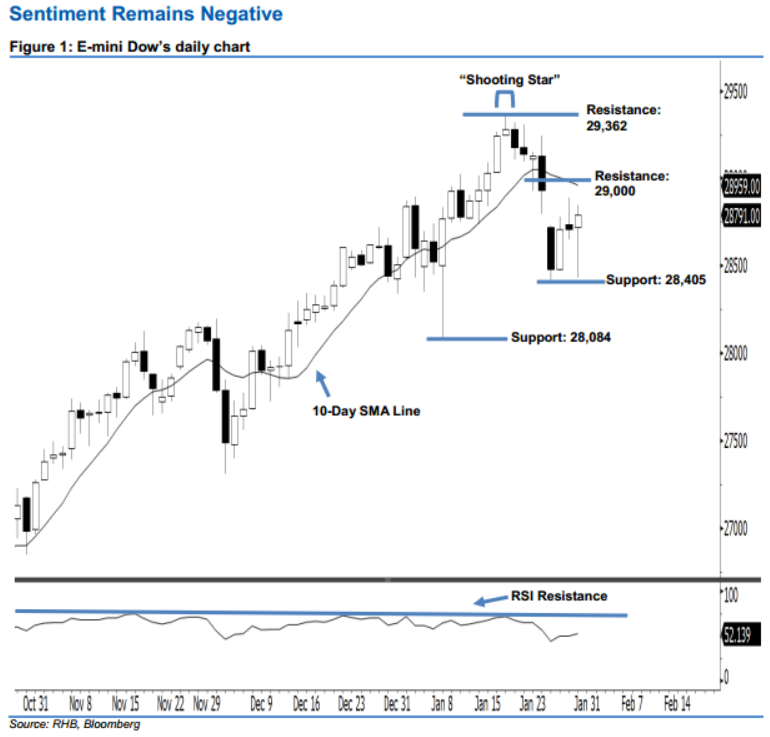

Negative sentiment remains intact; stay short. The E-mini Dow ended higher to form a positive candle last night. It gained 81 pts to close at 28,791 pts, off the session’s low of 28,432 pts. However, it is not surprising that the market is experiencing a technical rebound after the recent drop. On a technical basis, the negative sentiment stays intact. This is given that the index does not recover above the 10-day SMA line and the 29,000-pt resistance mentioned previously. Overall, we believe the downside swing that started from 17 Jan’s “Shooting Star” pattern is not diminished yet.

As seen in the daily chart, we are eyeing the immediate resistance level at the 29,000-pt psychological mark, also situated near the 10-day SMA line. Meanwhile, the next resistance is seen at the 29,362-pt historical high. To the downside, the immediate support level is anticipated at 28,405 pts, which was the low of 27 Jan. If a breakdown arises, look to 28,084 pts – obtained from the low of 8 Jan – as the next support.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 28,780-pt level on 30 Jan. A stop-loss set above the 29,000-pt threshold is advisable in order to limit the risk per trade.

Source: RHB Securities Research - 31 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024