COMEX Gold - Bullish Bias Stays

rhboskres

Publish date: Mon, 03 Feb 2020, 09:57 AM

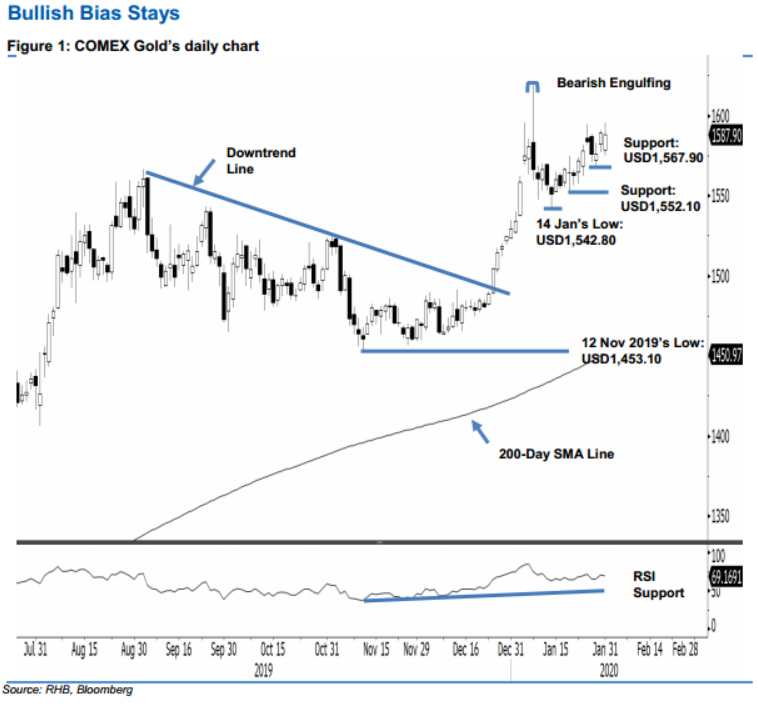

Maintain long positions while tightening up trailing-stop. The COMEX Gold traded in a relatively wide range in the latest session, between USD1,575 and USD1,595.50, before closing USD1.30 lower at USD1,587.90. The negative session did not suggest a price exhaustion signal and can be seen as just a minor pause by the bulls after the recent upward move. Towards the downside, we now believe as long as the immediate support of USD1,567.90 is not breached to the downside, the risk for the commodity to experience a retracement would still be contained. Maintain our positive trading bias.

As we are not observing signs of a retracement developing, we continue to recommend that traders stay in long positions. We initiated these at USD1,529.30, or the closing level of 31 Dec 2019. For risk-management purposes, a stop-loss can now be placed below the USD1,567.90 level.

We revised the immediate support to USD1,567.90, the low of 29 Jan. This is followed by USD1,552.10, or the low of 21 Jan. Conversely, the immediate resistance is expected to emerge at the USD1,600 round figure. This is followed by USD1,619.60, ie the high of 8 Jan’s “Bearish Engulfing” formation.

Source: RHB Securities Research - 3 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024