FKLI - Rebound Is Taking Place

rhboskres

Publish date: Fri, 07 Feb 2020, 04:35 PM

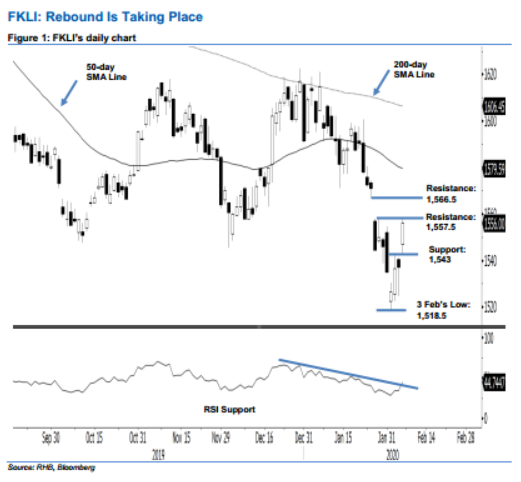

Initiate long positions as a rebound is in effect. The FKLI formed a white candle to close 19 pts higher, at 1,556 pts, yesterday. The high was registered at 1,558 pts. The strong close placed it above the previous immediate resistance of 1,543 pts, thereby signalling that the recent sharp retracement has probably reached an interim low. This, in turn, indicates that a countertrend rebound is taking place. The RSI which crossed above the resistance line is also a positive observation. As such, we switch our trading bias to positive.

Our previous short positions – initiated at 1,544.5 pts, the closing level of 28 Jan – were closed out at the breakeven point in the latest session. As we expect a rebound to be in effect, we initiate long positions at the latest close. To manage risks, a stop-loss can be placed below 1,543 pts.

Immediate support is now pegged at 1,543 pts, the high of 4 Feb. This is followed by 1,531 pts – derived from 5 Feb’s candle. Towards the upside, the immediate resistance is now at 1,557.5 pts – the high of 31 Jan. This is followed by 1,566.5 pts, the low of 24 Jan.

Source: RHB Securities Research - 7 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024