Hang Seng Index Futures - Taking a Breather

rhboskres

Publish date: Mon, 10 Feb 2020, 09:52 AM

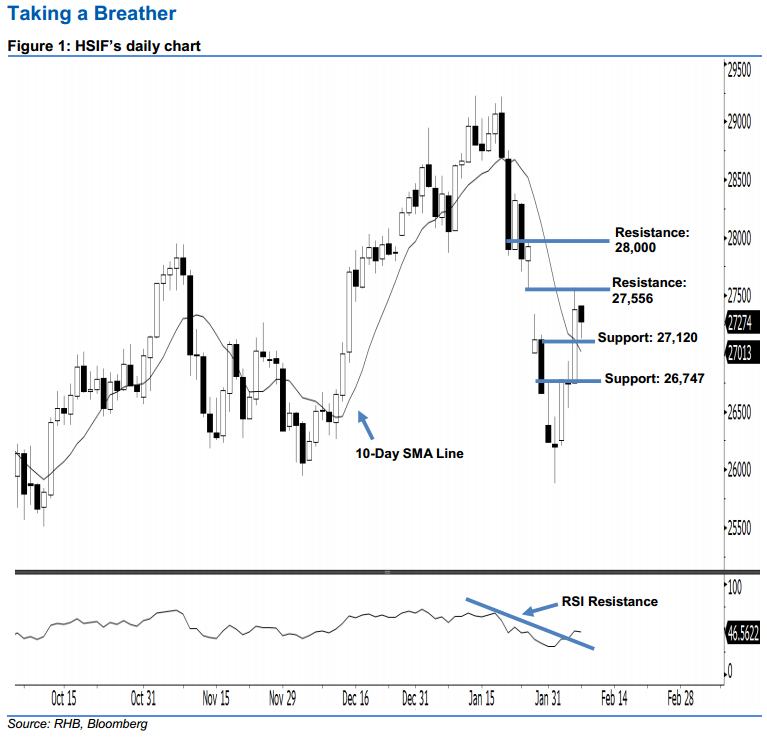

Stay long, with a trailing-stop set below the 27,120-pt support. The HSIF formed a black candle last Friday. It closed at 27,274 pts, after oscillating between a high of 27,413 pts and low of 27,129 pts. Still, on a technical basis, the formation of last Friday’s black candle can be viewed as a result of profit-taking activities that followed the recent gains seen over the past one week. We believe the bulls may continue to control the market, given that the HSIF is still trading above the 10-day SMA line. Overall, we think the upside swing remains intact.

As seen in the chart, we anticipate the immediate support level at 27,120 pts, set near the midpoint of 6 Feb’s long white candle. If a breakdown arises, look to 26,747 pts – ie the low of 6 Feb – as the next support. Towards the upside, we are eyeing the immediate resistance level at 27,556 pts, obtained from the downside gap resistance of 29 Jan. The next resistance is maintained at the 28,000-pt psychological mark.

Hence, we advise traders to maintain long positions, since we initially recommended initiating long above the 26,500-pt level on 5 Feb. In the meantime, a trailing-stop set below the 27,120-pt threshold is preferable in order to lock in part of the gains.

Source: RHB Securities Research - 10 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024