WTI Crude Futures - No Reversal Signal Yet

rhboskres

Publish date: Fri, 14 Feb 2020, 05:14 PM

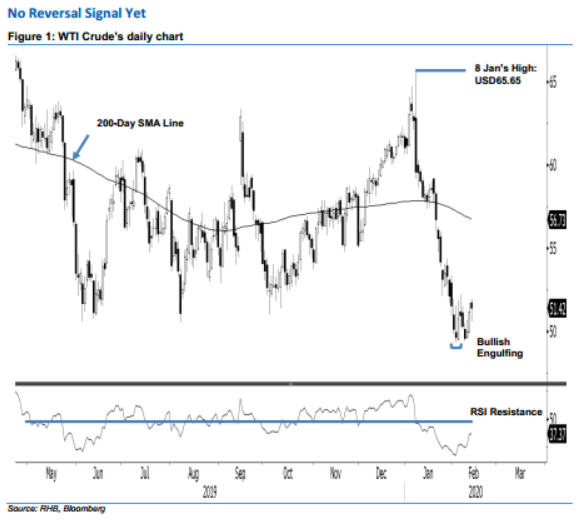

The bulls have yet to regain control; maintain short positions. The WTI Crude advanced USD0.25 to close at USD51.42 – trading ranged between USD50.60 and USD51.96. Price actions over the past near two weeks suggest the commodity is experiencing a possible sideways consolidation. This came after it experienced a relatively sharp retracement that started from the high of USD65.65 on 8 Jan, which saw its RSI reading reached an extremely oversold level two weeks ago. Once this consolidation is over, chances are high for the retracement to extend. Maintain our negative trading bias.

In the absence of a price reversal signal, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD52.29 level.

The immediate support is set at USD50.30, derived from 12 Feb’s candle. This is followed by USD49.31, or the low of 5 Feb’s “Bullish Engulfing” pattern. Meanwhile, the immediate resistance is maintained at USD51.50 threshold – derived from 10 Feb’s candle. This is followed by USD52.29, derived from 1 Feb’s candle.

Source: RHB Securities Research - 14 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024