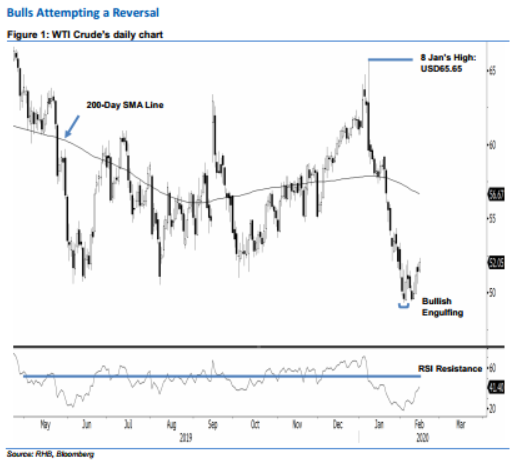

WTI Crude Futures - Bulls Attempting a Reversal

rhboskres

Publish date: Mon, 17 Feb 2020, 10:48 AM

Maintain short positions until a strong rebound is confirmed. The WTI Crude ended the latest session USD0.63 stronger at USD52.05. Trading ranged between USD51.32 and USD52.34. The closing level also placed the black gold above the previous USD51.50 immediate resistance. Until there are further positive price actions in the coming sessions – to settle the commodity above the USD52.29 resistance point – we believe the price actions over the past two weeks are still assembling the characteristics of a possible sideways consolidation. This is after the sharp retracement from the USD65.65 level, which was recorded on 8 Jan. Hence, we keep to our negative trading bias.

Until there is a confirmation of a reversal, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD52.29 level.

The immediate support is revised to USD51.30, which was derived from 13 Feb’s candle. This is followed by USD50.30, or 12 Feb’s candle. Towards the upside, the immediate resistance is now pegged at USD52.29, which was derived from 1 Feb’s candle. This is followed by USD53.50, derived from 29 Jan’s candle.

Source: RHB Securities Research - 17 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024