FKLI - No Confirmation For Reversal Yet

rhboskres

Publish date: Fri, 21 Feb 2020, 05:47 PM

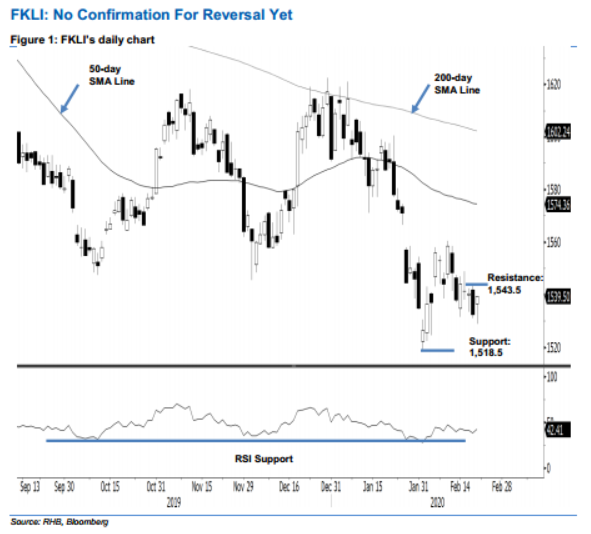

Maintain short positions as there is still no trend reversal signal spotted yet. The FKLI managed to stage a positive intraday price reversal to close 7 pts stronger at 1,539.5 pts. This was after it hit a low of 1,529 pts. Despite this, it was still insufficient to generate a price reversal signal. This implies the index’s retracement, which resumed on the back of a price rejection from the 1,557.5-1,566.5pt resistance zone, is still in place. Hence, we are keeping our negative trading bias.

As the risk for the 1,518.5-pt level to be tested is still high, we advise traders to stay in short positions. We initiated these at 1,548.5 pts, the closing level of 12 Feb. To manage risks, a stop-loss can be placed at the breakeven level.

The immediate support is set at 1,526.5 pts, derived from 5 Feb’s candle. This is followed by 1,518.5 pts, the low of 3 Feb. Moving up, the immediate resistance is set at 1,543.5 pts, 19 Feb’s high. This is followed by 1,550 pts, derived from 12 Feb’s candle.

Source: RHB Securities Research - 21 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024