Hang Seng Index Futures: Triggers Short Positions

rhboskres

Publish date: Tue, 25 Feb 2020, 11:23 AM

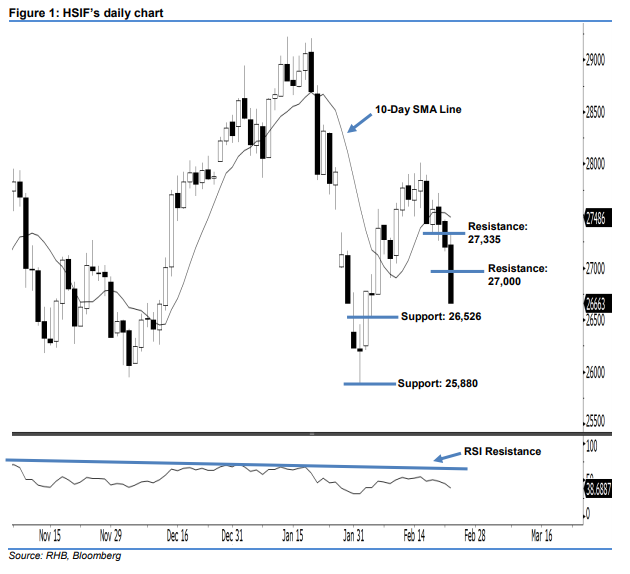

Initiate short positions below the 27,000-pt level. The HSIF formed a long black candle yesterday. It lost 537 pts to settle at 26,663 pts. We note that the index has formed a third consecutive black candle below the declining 10- day SMA line, which signals that the sentiment has turned negative. In addition, as the 14-day RSI indicator slid below the 50 neutral point to flash a bearish reading at 38.68, the bearish sentiment has been enhanced. In the meantime, 21 Feb’s closing has also triggered our trailing-stop, which we had previously recommended that investors set at the 27,340-pt threshold.

As seen in the chart, we are now eyeing the immediate resistance level at the 27,000-pt round figure. The next resistance would likely be at 27,335 pts, ie the high of 24 Feb. On the other hand, the immediate support level is seen at 26,526 pts, situated at 5 Feb’s low. The crucial support is anticipated at 25,880 pts, which was the previous low of 3 Feb.

Thus, we advise traders to initiate short positions below the 27,000-pt level. A stop-loss set above the 27,335-pt threshold is advisable in order to minimise the risk per trade.

Source: RHB Securities Research - 25 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024