FCPO: Bearish Bias Stays

rhboskres

Publish date: Thu, 27 Feb 2020, 09:25 AM

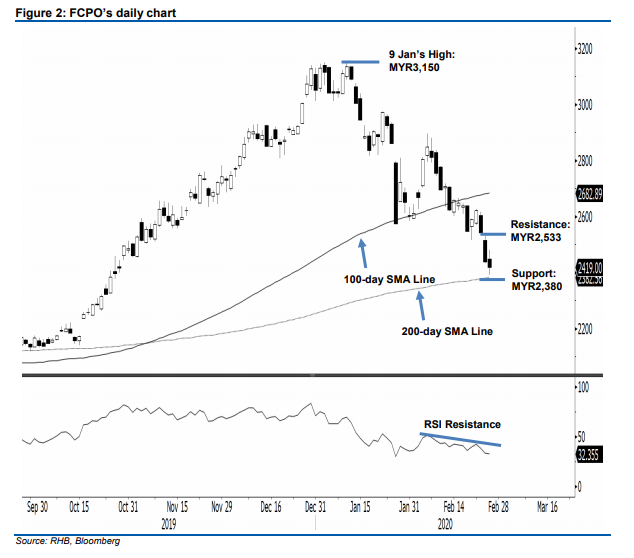

Maintain short positions as the trend is still negative. The FCPO failed to hold on to its earlier session’s gains, settling MYR19 lower at MYR2,419. Trading ranged between MYR2,393 and MYR2,482. The latest performance suggests that the bears are still in firm control and the correction phase that started from the high of MYR3,150 on 9 Jan is still firmly in place. The negative session has also sent the commodity closer towards the 200-day SMA line. Price actions around this SMA line in the coming sessions are critical in signalling the commodity’s next direction. Hence, we are keeping our negative trading bias.

With no positive price trend sighted, traders are advised to remain in short positions. We initiated these at MYR2,695, the closing level of 11 Feb. To manage risks, a stop-loss can be placed above MYR2,533.

Towards the downside, the immediate support is maintained at the MYR2,400 round figure, followed by MYR2,380, near the current 200-day SMA line reading. Meanwhile, the immediate resistance is pegged at MYR2,485, followed by MYR2,533 – both are derived from 25 Feb’s candle.

Source: RHB Securities Research - 27 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024