Hang Seng Index Futures: Outlook Remains Negative

rhboskres

Publish date: Fri, 28 Feb 2020, 06:36 PM

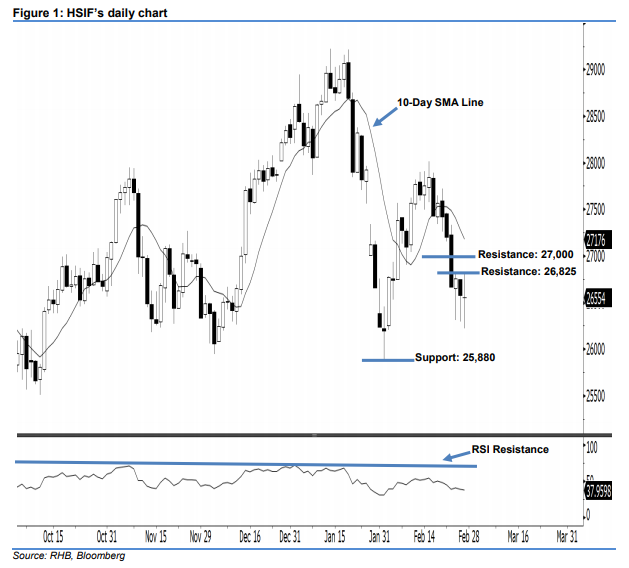

Stay short while setting a trailing-stop above the 26,825-pt level. The HSIF formed a “Doji” candle yesterday. It settled at 26,554 pts, off its high of 26,813 pts and low of 26,218 pts. Yet, the emergence of yesterday’s “Doji” candle merely indicates that the sellers may be taking a breather after the recent losses. Given that the index has remained below the declining 10-day SMA line, this implies that the bearish sentiment is still intact. Overall, we believe that the downside swing – which started from 18 Feb’s black candle – may carry on.

Based on the daily chart, we anticipate the immediate resistance level at 26,825 pts, determined near 25 and 27 Feb’s highs. Meanwhile, the next resistance is maintained at the 27,000-pt round figure, situated near the midpoint of 24 Feb’s long black candle as well. To the downside, we are now eyeing the near-term support level at the 26,000-pt psychological mark. This is followed by 25,880 pts, ie the previous low of 3 Feb.

Hence, we advise traders to maintain short positions, since we had originally recommended initiating short below the 27,000-pt level on 25 Feb. For now, a trailing-stop can be set above the 26,825-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 28 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024