Emini Dow Futures: Trading Below 200-day SMA Line

rhboskres

Publish date: Fri, 28 Feb 2020, 06:37 PM

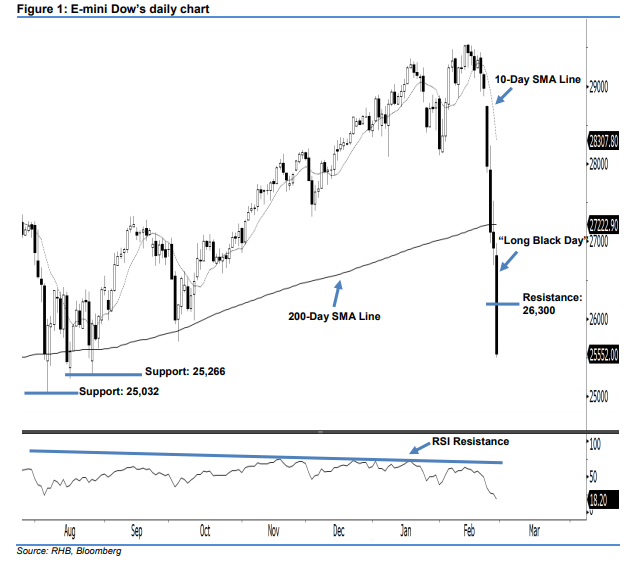

Market slumped to 6-month low; stay short. The selling momentum in the E-mini Dow continued as expected, as a “Long Black Day” candle formed last night. It slumped 1,362 pts to settle at 25,552 pts. Technically, market sentiment remains bearish, given that the index has posted a sixth consecutive black candle and hit its 6-month low. Furthermore, the E-mini Dow has recently breached below the 200-day SMA line, which has enhanced the bearish sentiment. Overall, we stay bearish on the index’s outlook.

According to the daily chart, the immediate resistance level is seen at the 26,000-pt psychological mark. The next resistance is anticipated at 26,300 pts, situated near the midpoint of 27 Feb’s “Long Black Day” candle. On the other hand, the near-term support level is now seen at 25,266 pts and 25,032 pts, obtained from the previous low of 26 Aug 2019 and 6 Aug 2019 respectively.

To re-cap, on 25 Feb, we initially recommended traders to initiate short positons below the 28,105-pt level. We continue to advise them to stay short for now, while setting a trailing-stop above the 26,300-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 28 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024