WTI Crude Futures - Retracement Is Extending

rhboskres

Publish date: Mon, 02 Mar 2020, 09:59 AM

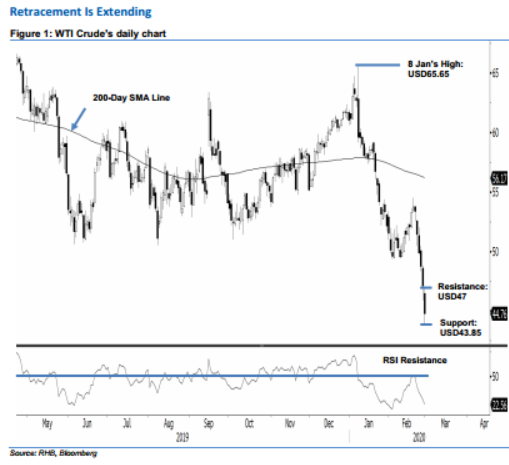

Oversold, yet no reversal signal; maintain short positions. The WTI Crude’s retracement leg that started from the high of USD65.65 on 8 Jan is still not showing signs of hitting an end. It settled USD2.33 lower at USD44.76 in the latest session – thereby breaching below the previous support levels of USD47 and USD45.88. The negative price momentum remains strong, despite the oversold RSI reading – indicating a firm control by the bears. In the absence of a price reversal signal, we are keeping our negative bias.

As the bearish bias is not showing indications of wearing off, we recommend traders to stay in short positions. We initiated these at USD49.90, the closing level of 25 Feb. To manage the risk, a stop-loss can be placed above USD47.00.

We revised the immediate support to USD43.85, the latest low. This is followed by USD43.36, the low of 24 Dec 2018. Moving up, resistance points are pegged at USD46 and USD47 – both are derived from 28 Feb’s candle.

Source: RHB Securities Research - 2 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024