COMEX Gold - A Washout Session

rhboskres

Publish date: Mon, 02 Mar 2020, 10:01 AM

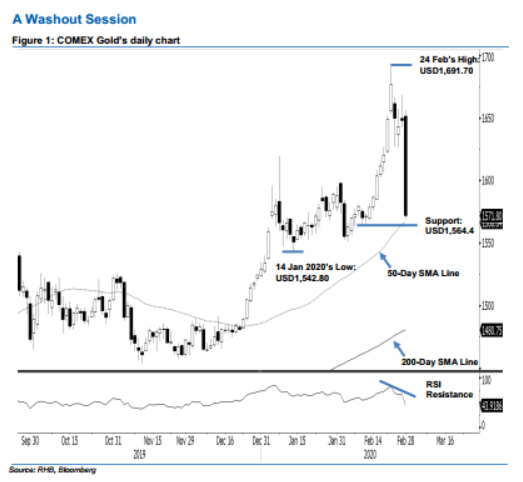

Short positions triggered by a washout session. The COMEX formed a long black candle which decisively crossed below the previous support levels – and back into the previous multi-week’s correction zone as well as the process came in near to test the 50-day SMA line. The sharp decline has, in our view, signalled the commodity’s upward move has reached an interim top and may be in the process of developing a deeper correction phase. Should the said SMA line be breached in the coming sessions, it could further enhance the case for a further retracement. Hence, we switch our trading bias to negative.

Our previous long positions initiated at USD1,586.40, ie the closing level of 13 Feb, were closed out at USD1,620 in the latest session. On the bias that the commodity has entered a correction phase, we initiate short positions at the latest close. For risk management purposes, a stop-loss can be placed above the USD1,600 mark.

We revised the immediate support to USD1,564.4, the low of 12 Feb. This is followed by USD1,542.80, the low of 14 Jan. Towards the upside, the immediate resistance is revised to USD1,585, derived from the latest candle. This is followed by the USD1,600 round figure.

Source: RHB Securities Research - 2 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024