E-mini Dow Futures - Seventh Consecutive Black Candle

rhboskres

Publish date: Mon, 02 Mar 2020, 10:05 AM

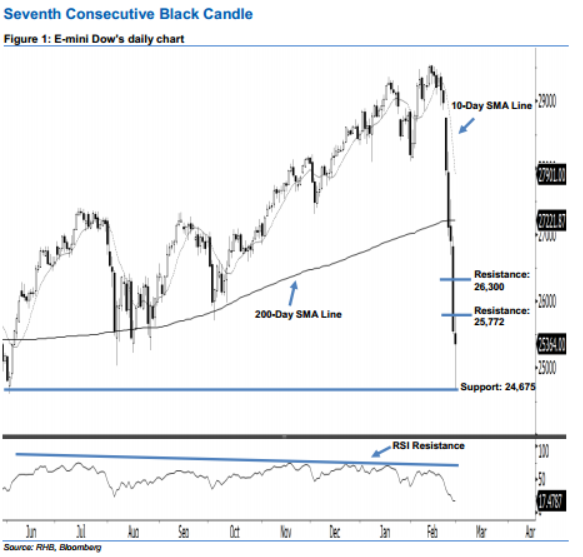

Charts another black candle; stay short. The E-mini Dow’s downside move continued as expected, as another black candle was formed last Friday. It lost 188 pts to close at 25,364 pts. As the index has marked a lower close below the 200-day SMA line, this can be viewed as the bears expanding their downward momentum. In view of the E-mini Dow posting a black candle for the seventh consecutive day, this indicates that the market correction – which began from 13 Feb’s high – may go on.

As seen in the chart, we anticipate the immediate resistance level at 25,772 pts, ie the high of 28 Feb. The next resistance will likely be at 26,300 pts, which is set near the midpoint of 27 Feb’s long black candle. Towards the downside, we are eyeing the immediate support level at 24,675 pts, ie the low of 28 Feb. Meanwhile, the next support is seen at the 24,000-pt psychological spot.

Hence, we advise traders to maintain short positions, since we initially recommended initiating short below the 28,105-pt level on 25 Feb. For now, a trailing-stop can be set above the 25,772-pt threshold to lock in a larger part of the gains.

Source: RHB Securities Research - 2 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024