Hang Seng Index Futures - the Downward Momentum Resumes

rhboskres

Publish date: Thu, 05 Mar 2020, 05:25 PM

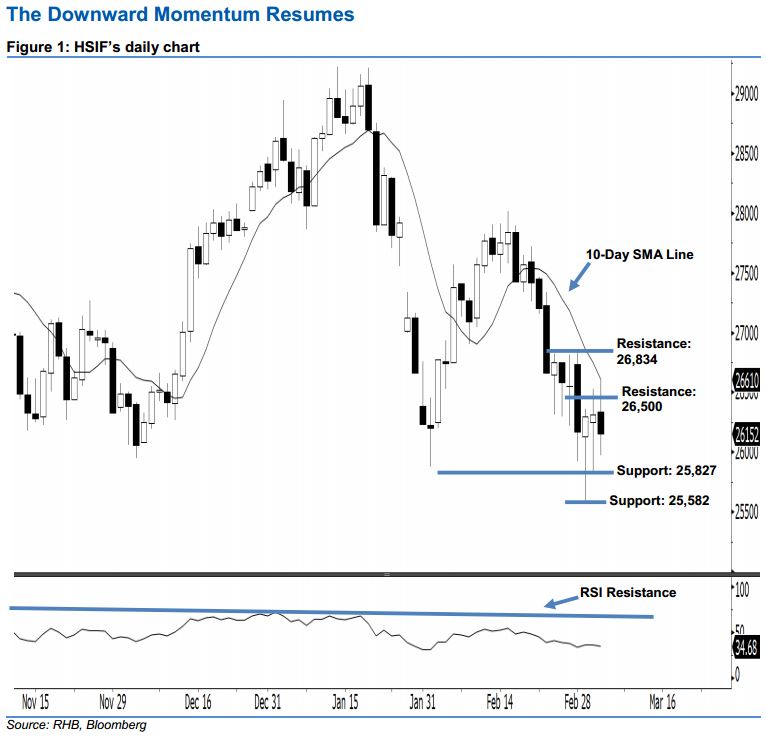

Maintain short positions. The HSIF formed a black candle yesterday. It settled at 26,152 pts, off its high of 26,611 pts and low of 25,971 pts. Based on the current outlook, we think the downside move is not diminished yet, as yesterday’s candle has erased most of the previous session’s gains. Given that the HSIF is still trading below the declining 10-day SMA line, this implies the downside swing that started from 18 Feb’s black candle may carry on. Overall, we remain negative on the index’s outlook.

Based on the daily chart, the immediate resistance level is seen at 26,500 pts, which is set near the midpoint of 28 Feb’s long black candle. The next resistance will likely be at 26,834 pts, ie the high of 28 Feb. To the downside, we are now eyeing the immediate support level at 25,827 pts – this was defined from the low of 3 Mar. Meanwhile, the next support is maintained at 25,582 pts, which was the previous low of 2 Mar.

Therefore, we advise traders to stay short, following our recommendation of initiating short below the 27,000-pt level on 25 Feb. A trailing-stop set above the 26,500-pt mark is advisable to limit the risk per trade.

Source: RHB Securities Research - 5 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024