E-mini Dow Futures - Sentiment Remains Bearish

rhboskres

Publish date: Wed, 11 Mar 2020, 04:39 PM

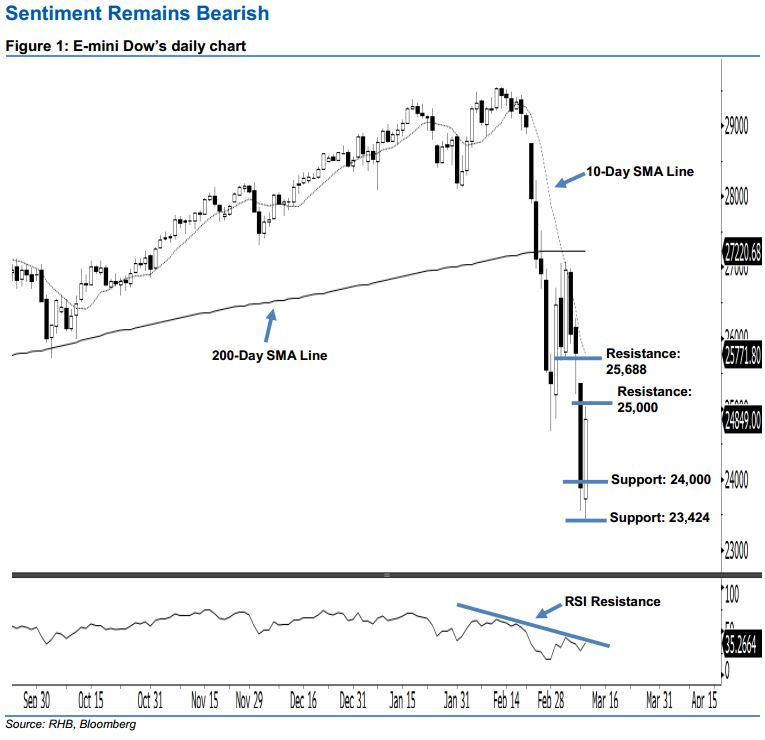

Stay short, with a stop-loss set above the 25,000-pt resistance level. After posting three black candles in a row, the E-mini Dow ended higher to form a white candle last night. It surged 972 pts to close at 24,849 pts, off the session’s low of 23,424 pts. Unsurprisingly, yesterday’s white candle should be viewed as a technical rebound following the recent losses. We think the downside move is not diminished thus far, given that the index has not broken above the 25,000-pt resistance mentioned previously. With the 10-day SMA still pointing downwards, the negative sentiment remains unchanged.

As seen in the chart, the immediate resistance level is maintained at the 25,000-pt psychological mark. The next resistance is situated at 25,688 pts, ie the low of 4 Mar. On the other hand, we are now eyeing the near-term support level at the 24,000-pt round figure. This is followed by 23,424 pts, obtained from the previous low of 10 Mar.

Therefore, we advise traders to stay short, since we initially recommended initiating short below the 24,675-pt level on 10 Mar. A stop-loss set above the 25,000-pt level is advisable in order to minimise the risk per trade.

Source: RHB Securities Research - 11 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024