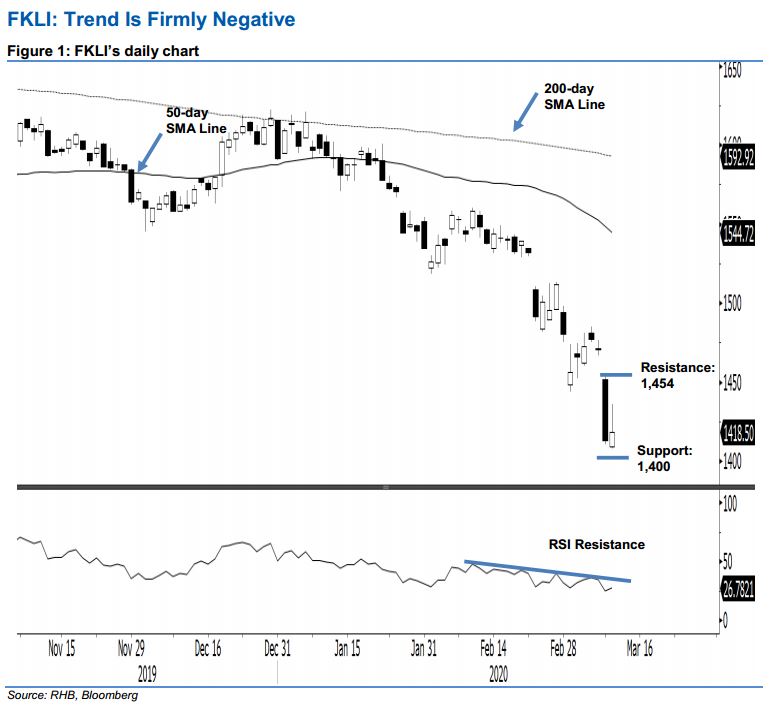

FKLI - Trend Is Firmly Negative

rhboskres

Publish date: Wed, 11 Mar 2020, 04:58 PM

Minor bounce after a sharp drop – maintain short positions. The FKLI staged a rebound during the latest session. However, it settled widely below the intraday high of 1,436 pts – settling 5.5 pts higher at 1,418.5 pts. The positive session set in after the prior session’s steep decline. Nevertheless, given the index’s inability to retain most of its gains, as well as its failure to close above the 1,422-pt immediate resistance, implies that the overall weak trend remains firmly in place. This is further supported by the fact that the FKLI has broken its multi-year support level of 1,500 pts. We maintain our negative trading bias.

As there were no price reversal signals, we recommend traders to remain in short positions. We initiated these at 1,548.5 pts, or the closing level of 12 Feb. To manage risks, a stop-loss can be placed above the 1,454-pt mark.

The immediate support is set at the 1,400-pt round figure, followed by 1,380 pts, ie the low of 10 Oct 2011. Moving up, the immediate resistance is set at 1,430 pts, followed by 1,454 pts – both were derived from 9 Mar’s candle.

Source: RHB Securities Research - 11 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024